The ousted founder of ADVFN, Clem Chambers is back with a bold new venture: www.Anewfn.com The pending launch comes on the heels of significant turmoil at ADVFN, where new management has been criticized for its handling of the platform, leading to a dramatic decline in share price and business performance.

The ousted founder of ADVFN, Clem Chambers is back with a bold new venture: www.Anewfn.com The pending launch comes on the heels of significant turmoil at ADVFN, where new management has been criticized for its handling of the platform, leading to a dramatic decline in share price and business performance.

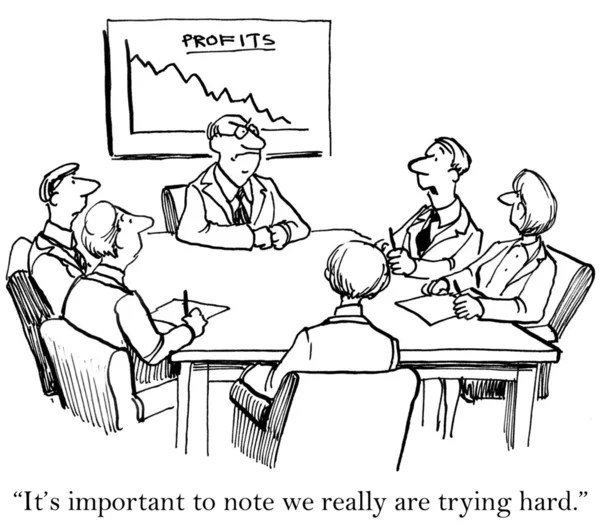

The nosedive in ADVFN value since the change of management is eye watering. They’ve taken a profitable venture and inflicted a catastrophic drop in sales, which in turn has lead to value destruction. The share price has plummeted from over 80p reaching lows just above 10p, and currently hovers in-between 17p/18.50p. The forthcoming year-end accounts will no doubt reveal more ‘troubling figures’, Mired in expensive legal acrimony with the former BOD is in itself an indication of ‘fumbling in the dark for excuses’ it undermines faith in ADVFN’s ability to recover.

In response to these challenges, Chambers and his team have decided to embark on a new journey by creating www.AnewFN.com This platform aims to fill the void left by ADVFN’s decline, offering innovative features with a fresh approach to financial information. The OBC team, which founded ADVFN and operated it successfully for two decades, are poised to leverage their experience to create a platform that caters specifically for the needs of private investors.

In response to these challenges, Chambers and his team have decided to embark on a new journey by creating www.AnewFN.com This platform aims to fill the void left by ADVFN’s decline, offering innovative features with a fresh approach to financial information. The OBC team, which founded ADVFN and operated it successfully for two decades, are poised to leverage their experience to create a platform that caters specifically for the needs of private investors.

Chambers, rumoured to now be operating out of Estonia, believes that there is a solid audience waiting to be served, with significant revenue growth opportunities. Their vision is to revolutionize the financial information landscape once again, leveling the playing field for individual investors.

The creation of AnewFN is a serious threat in the space that ADVFN occupies..

ADVFN’s new kid on the block, CEO Amit Tauman, needs to pull his ‘mathematical fingers’ out of his ‘machine learning arse’. Tauman has what I’d describe as ‘Super Computer Intelligence’. He really is Academia Illuminati, with more degrees than a compass, make no mistake the kid is a genius, however in the real world of business and finance, especially on the wild west casino that is the AIM, it’s his ability to assimilate that intelligence with the reality of the sector and business space that ADVFN inhabit that ultimately will decide its fate. Shareholders and users of ADVFN are the life blood of the company, failure to engage, specifically ‘In Person’ by the whole board is endemic. That, among much more, needs to be addressed.

Users have noted a lack of meaningful development on the site. Beyond some cosmetic changes, the platform has seen a decay in its features and a deterioration in the quality of service that once distinguished it in the financial sector. It appears that the new team has taken ADVFN to a new level marked by reduced functionality and a failing business model. Their investment threads are awash with rebellious complaints.

Users have noted a lack of meaningful development on the site. Beyond some cosmetic changes, the platform has seen a decay in its features and a deterioration in the quality of service that once distinguished it in the financial sector. It appears that the new team has taken ADVFN to a new level marked by reduced functionality and a failing business model. Their investment threads are awash with rebellious complaints.

I’ve always had a soft spot for the platform and actually was co founder of the Jekyll & Hyde tip sheet in Jan’ 2017. A quick scan of the page reveals not one change in graphics since launch. The actual video with me in it is still there, while the banner declaring me as MR Hyde is emblazoned for all to see. I am not Mr Hyde. That’s minor, I know, but it’s indicative of the general malaise in graphics, functionality and Board engagement with their base.

I’ve always had a soft spot for the platform and actually was co founder of the Jekyll & Hyde tip sheet in Jan’ 2017. A quick scan of the page reveals not one change in graphics since launch. The actual video with me in it is still there, while the banner declaring me as MR Hyde is emblazoned for all to see. I am not Mr Hyde. That’s minor, I know, but it’s indicative of the general malaise in graphics, functionality and Board engagement with their base.

As they prepare for the launch, Chambers invites early users and shareholders to sign up for exclusive access and updates. By visiting www.anewfn.com, interested parties can leave their email addresses to stay informed about the platform’s development and participate in special offerings. I signed up 3 weeks ago. Here’s a tip from ‘retired’ Mr Hyde: If anyone from ADVFN SIGNS UP then don’t forget to change your IP and use a ‘jenk’ email.

Additionally, the OBC team plans to rebrand itself as Online PLC, distancing from the controversial associations of blockchain technology in the UK. While they remain supporters of blockchain, their focus has shifted towards building a premier financial website that prioritizes user experience and quality service. There are ‘Rumours’ of a NOMAD sourced for AnewFN with an investor pot of up to £25M. Time will tell… But It’s going to get spicey….

Conclusion: Chambers v Tauman

www.Anewfn.com Could represent a potential turning point for the market. As ADVFN struggles under its new management, can AnewFN rise to challenge and surpass it, offering an alternative fit for use and user friendly financial site for private investors? Or can Tauman finally get his Board up to speed and on message taking a grip of ADVFN, pushing the SP upwards?

new management, can AnewFN rise to challenge and surpass it, offering an alternative fit for use and user friendly financial site for private investors? Or can Tauman finally get his Board up to speed and on message taking a grip of ADVFN, pushing the SP upwards?

Let battle commence.

Viva

Dan

x

Dan, It’s a get the popcorn in moment.

Can’t these guys ever stop bickering?

Advfn under the Israelis sucks. Now realize how well managed it was under Clement.

Look at the greater picture. Most backed the takeover. Now we’re yearning for the old boys back Lifes a bitch. I cancelled my premium subs. Still I hope the newbies in charge turn it around

Good to see you back. I actually made a few pennies from your sit Dan.

So you back from where ever you’ve gone. Been quiet Dannyboy, You been in Nick again? LOL

ADVFN it’s gone to pot! On that we agree.

All the best Daniel

Roper

Why don’t they just takeover advfn. Seems an easier thing than building a new platform that could destroy their original business. Madness imho.

So a Takeover of the Takeover by the Takenover of the Takeoverers LOL!

Dan

x

Daniel,

Out of curiosity, could you reply to my queries?

(1) What’s your opinion of our current ADVFN board?

(2) Where do you see the share price in 2025?

(3). Do you hold stock or intending to purchase?

Thanks

Andy J

1/ Maybe needs the CEO to make a 1 or 2 of tweaks. I think they can turn it around but they have to really start from the bottom up, not the top down.

2/ Depends on revenues thus it’s deal dependent. Never a good move to enter in2 a legal fight of any kind especially with a former Board, it’s an anchor on the SP. Hence most traders steer clear.

3/ No stock, but always on my watchlist.

Daniel

x