In the wake of the ‘rumoured’, Israeli group front man, Ex ADVFN Director, Yair Taumans notification (TR1) that doubled the holding to 18.31%.

In the wake of the ‘rumoured’, Israeli group front man, Ex ADVFN Director, Yair Taumans notification (TR1) that doubled the holding to 18.31%.

Can the present Board of ADVFN: (LON AFN) keep control of the company?

That’s the question doing the rounds in the City of London as you read this.

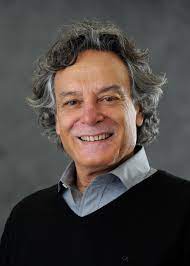

Looking at the QXL history and the ‘contentious’ 2015 attempt at wrestling control of ADVFN, it’s almost certain, there will be further increases in holdings from both combatants in the fight for what the takeover group probably see as a potential lucrative cash cow that’s under-performed. After taking control of QXL , the sp was sub 1p eventually rising to a staggering £17,  before the company was bought out for close to £1B, at £14+, in 2007. I’m sure the Board of ADVFN are aware of exactly who’s involved, what they hold, both declared/undeclared and who is supporting them. These are mega wealthy people and know the market inside out; Yair Tauman, is a highly respected, Professor of Economics at State University of New York, Stony Brook and the Director of the Stony Brook Centre for Game Theory.

before the company was bought out for close to £1B, at £14+, in 2007. I’m sure the Board of ADVFN are aware of exactly who’s involved, what they hold, both declared/undeclared and who is supporting them. These are mega wealthy people and know the market inside out; Yair Tauman, is a highly respected, Professor of Economics at State University of New York, Stony Brook and the Director of the Stony Brook Centre for Game Theory.

The conundrum is, will those currently trying to ‘kick in the front door’ cease and desist and knock on the front door? If so how will the present Board react? Rumours current are that there’s a shadowy concert party pulling the strings, through nominee accounts from as far away as USA, Israel, Cyprus, Switzerland and the Bahamas to name but 5 of the many locations I’m hearing.

Those running the Company are duty bound, if approached via a ‘polite knock’ on the front door, to enter into negotiations. ‘Thems’ are the rules corporate and regulatory. If you’re approached then you have a duty as well as a responsibility to sit down and listen to the proposal. It’s as simple as that. Hammer out a deal. In the real world of business everyone is up for a deal. ADVFN and the Professor are no different.

As it stands, I can’t see these people making the same mistakes as 2015. Both parties are corporate, business, savvy, both know that the other will not blink in a hostile takeover situation. But is that really in the best interests of shareholders?

ADVFN could probably muster 25% to 30% of existing holders to keep control. But that would not be enough. If a requisition drops, which is by it’s very nature ‘Hostile’ then their only way of defeating the Israelis is via ‘legalese‘. As I read it, the interested party can call up or will soon be in a position to call up, over 40% of the votes…

So, the value drivers at the moment are increased holdings TR1s from the Tauman group, as well as Director buys and option, warrant exercises by the incumbent’s. That should or could catapult the SP to between £1/£2. Of course if an RNS drops announcing ADVFN are in official takeover talks or a Requisition is RNS’d and these two are highly likely given the history. Hindsight, with a look at the meteoric QXL rise, then £4+ isn’t out of the question from a current share price of 63p. If I was either of the combatants I’d reach out officially and get in too talks. That’s the key here to it all.

Make no mistake there’s a corporate battle being played out behind the scenes for control and the share price will rollercoaster higher.

As always take care. Greed is the enemy.

Dan