There’s never a dull moment on the London Alternative Investment Market (AIM) particularly when one is trying to work out whether we’re being sold a ’pup’. You’ve got to go through all the available documents line by line, then re-read each and every document line by line. As well as using all available sources to see what you can come up with, such as what the company are involved with below the radar and how this could affect value going forward. (More on this below)

There’s never a dull moment on the London Alternative Investment Market (AIM) particularly when one is trying to work out whether we’re being sold a ’pup’. You’ve got to go through all the available documents line by line, then re-read each and every document line by line. As well as using all available sources to see what you can come up with, such as what the company are involved with below the radar and how this could affect value going forward. (More on this below)

Such is the convoluted nature of the Saffron Energy Reverse Takeover. Black-tie events apart & the machinations of Po Valley assets in, out, suspension, relist, suspension, relist, AGM dates constantly re-jigged etc. The information saturation on this one would take its toll on the patience of a saint.

But now all finally seems to be coming to fruition. The well-known corporate bastard, (CB) James Parsons (JP) and his team of lessor corporate bastards are now ready to and no doubt raring to go. Being classed as a ’Corporate bastard’ may ‘sound’ (No pun intended) harsh. Far from it. Again, unless you’re steeped in corporate culture you’d not realise that this is a worthy accolade, of sorts….. A corporate bastard gets the job done for his/her shareholders and the benefit of the company. Warren buffet is a corporate bastard. The head of BP is a corporate bastard. They are bringers of value. They do what is necessary regardless of short term pain for long term gain. When choosing an investment or a short-term trade always bet on the CB. Proven management bring value. Proven shysters lose value.

All too often we as investors/traders are sold down the river by corporate shyster lifestyle companies operating on the AIM, it’s littered with them, in fact it’s like a backed-up lavatory at a Japanese POW camp, literally over-flowing. I’ve watched and followed the bowel movements of these companies and have written and exposed many of the dirty tricks that they try to pass off as good business when it’s anything other than good. So, it makes a change when a real opportunity comes along. Such as Sound Energy that hit over £1 & the great Echo bonanza that rallied to over 25p in the first few months of development.

At the moment we all await the Saffron AGM which is nothing but a rubber stamp of the proposed terms of the RTO. Trying to cut through the corporate speak and get to the nitty-gritty of what comes out of the other end has in my opinion not been very well communicated to share-holders and those looking to trade/invest post the AGM ratification of the RTO.

So, I’ll break it down into common parlance. Layman’s terms. I’ll also give the readers of my most wonderful blog site the heads up on what is currently going on in Indonesia. Humpty Dumpty

Pre-the AGM there’s 200,000,000 million Saffron shares in issue. Post AGM, on the 29th March 2018, there will be a new company formed: Coro Energy (LON: CORO) with team JP at the helm.

Shares in issue will be 716,809,735. Warrants & Options outstanding will amount to 236,817,341. The warrants will have a strike price of 6.57p, the placing shares have been sold at 4.38p per share. There will be circa $15M in cash, virtually debt free with bread & butter production. The Company’s cornerstone investor, CIP, together with Continental Investment Partners S.A.,Metano Capital S.A. and Greenberry S.A, Marco Fumagalli and James Parsons have been classed as a ‘Concert Party’ they will hold, post AGM, 22.82%. Po Valley will, unless they’ve been selling pre AGM , hold 100,000,000 (13.95%). There will also be an open offer of 45,662,100 shares to existing shareholders. There will be a plethora of ‘Lock ins’ on stock held, most will stick to the lock in. But me being me I don’t set much store by them. One lot who will be slowly drip feeding into the rises will be Po Valley. Regardless of what they say….

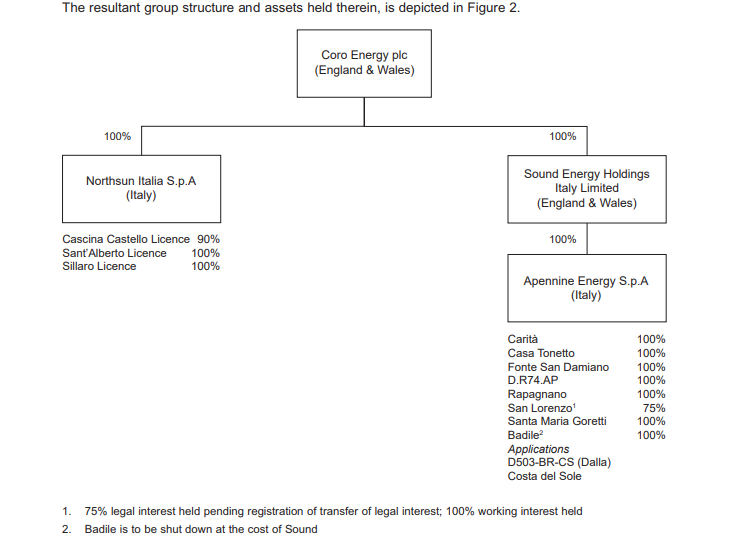

Following the AGM ratification, in aggregate, the Company will own 2P (proved and probable) gas reserves of 205.10 MMscm, 2C (contingent) gas resources of 660.20 MMscm, and 2C oil resources of 2.40 MMbbls. The best way to understand the structure of the newly formed entity is the pictograph (Right).

The asset base post AGM will be cash generative which will increase as Coro invest and rework over existing and new fields in Italy.

Now the main direction of Coro will begin to focus on South east Asia, Indonesia and Malaysia.

I was down as a placee until the suspension and pulled out due to the ever-changing time line of readmission and terms. Now PVO are out, which is a much better value driver for Coro. Too many CEOs aren’t good for stability. Just as too many cooks spoil the broth, too many CEOs fuck the company up. Now they’re out. That’s good news all round.

It’s known by ‘Yours Truly’ that Coro are in advanced negotiations with several Indonesian oil & gas companies and are in talks with the Indonesian state-owned oil company PERTAMINA. One of their new directors, Ilham Habibi, (Son of a former President of Indonesia) has direct access to the top echelons of PERTAMINA. I know this because I met Mr Habibi in Indonesia last year. (I was on Sefton business) Several of the assets I toured were up for grabs including a 10 Million scuffs a day gas producer with half a TCF resource. And a 3,000 bopd asset owned by Fosters oil. So, you can take it as read that there’s going to be multi TCF Indonesian exploration/production assets brought into Coro some time in 2018.

Any news on big exploration gas/oil licences or producing oil/gas assets will set the share-price on fire. It’s a no-brainer that the SP will rise. The question isn’t ‘if’ it’s when. Any thing under 5p is a steal. Any one selling now will rue the day… I’ve set a target between 12p-15p over the next 12 months. And as ever will closely follow the news and the developing story. Investors should do likewise, keep researching them. It will pay off.

I have to ‘fess up’ that I’ve been holding/buying shares in Saffron for quite some time! 🙂

Get ready for ‘Go’ on Coro!

Dan