FinnAust Mining (LON: FAM) is a dual AIM and Frankfurt Stock Exchange listed resources exploration company which currently has a number of prospective licences in Greenland, Austria and Finland. The company came to the London market in December 2013 following the £7.7 million reverse takeover of Centurion Resources. This brought with it a major shareholder in the form of ASX-listed nickel producer Western Areas, who we will discuss in more detail later, and which put up £1.8 million into the £3.4 million IPO placing at a price of 5p per share.

Having an initial focus on a range of early stage copper assets, shares in FinnAust fell steadily over the two years following its IPO as a result of a 35% fall in the price of the metal. However, a move into titanium in December 2015, driven by new Managing Director Rod McIllree, caught the market’s attention and breathed a new lease of life into the shares, which are amongst the best performing on the whole of AIM in the year to date.

FinnAust’s current assets are as follows:

Finland – owns 100% of a portfolio of copper, zinc and nickel projects; the Hammaslahti CopperGold-Zinc Project, the Outokumpu Copper Project and the Kelkka Nickel Project. In January this year additional licences were granted over the project areas, increasing the land area by c.50%. While these are not the current area of focus FinnAust still sees value in the assets.

Austria – an 80% interest in the previously producing Mitterberg Copper Project in Salzburg. This is largely a legacy asset from the reverse takeover of Centurion Resources and FinnAust is currently looking at realising its value.

Greenland – the current focus of the company’s activities is the Pituffik Titanium Project in Greenland. FinnAust has an interest in the asset via its 60.37% stake in Bluejay Mining Limited, the 100% owner of the project, which was acquired in March this year.

The Greenland assets were added to in September this year when FinnAust agreed to acquire 100% of Avannaa Exploration from Capricorn Oil, a subsidiary of Cairn Energy, for £500,000 in new FinnAust shares. The two most noteworthy projects are the Disko-Nuussuaq nickel-copper-platinum project and the Kangerluarsuk SedEx lead-zinc-silver project. Located in the south-west of the country the assets had over $50 million spent on them prior to being bought by Cairn and are believed to have high-tonnage and high-grade base metal potential. The deal is conditional upon approval from the Greenland government and expected to be completed within the next few weeks.

Pituffik

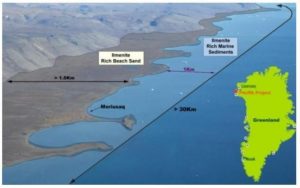

Touted as a potentially world class asset, the Pituffik Titanium Project is located on the Steensby

Land peninsular in the north-west of Greenland, 83km south of the regional settlement Qaanaaq (pop. 656) and part of the Thule black sand province. Here, the coastline contains areas of high concentrations of the mineral ilmenite (the most commercially important source of titanium), on active and uplifted beach zones, which are the focus of Bluejay Mining. Bluejay holds exploration licences over 150km² of onshore ground and shallow marine environments at the project.

The acquisition price (for 60.37% of Bluejay remember) was a maximum of £905,607, paid for via the issue of 164,655,885 new shares in FinnAust at a price of 0.55p per share. Of these, 40,755,885 shares are deferred (see more below) and there is a four year option to acquire the remaining 39.63% stake (another point discussed in more detail later). The Bluejay vendors include, interestingly, FinnAust’s Managing Director Rod McIllree and Non-Executive Greg Kuenzel (of Noricum Gold fame). Along with the acquisition, a placing of 10 million new shares at a price of 2p each raised just £200,000 with major shareholder Western Areas putting in half of this.

As you can infer from the picture below, Pituffik is not somewhere you would want to go for your summer holidays, being located in the Arctic Circle and experiencing harsh climatic conditions. Despite the cold, Greenland has actually been warming up, with climatic changes causing its ice sheet to retreat and exposing new areas for minerals exploration  and exploitation.

and exploitation.

While originally being discovered in 1915 Pituffik remains an early stage exploration asset.

It caught FinnAust’s attention due to having high grade material and exploitation potential. Historic fieldwork by Bluejay, the Geological Survey of Greenland & Denmark and others has highlighted the presence of a very large and, according to the company, “unusually pure” titanium deposit at Pituffik. Active beaches in the region have demonstrated grades of up to 68% ilmenite, averaging between 38-40%, with the more expansive uplifted beaches averaging around 17%. Upon acquisition FinnAust’s CEO McIIlree gushed that Pituffik has the potential to “become one of the highest grade in situ deposit of ilmenite anywhere in the world.”

There are two key areas which have been identified for further work at the project, Moriusaq and Interlak, located along an 80km coastline in environments including raised beaches, active beaches and drowned (underwater) beaches. Moriusaq is the most advanced area and has returned the highest ilmenite grades to date, with grades in some areas estimated to be in excess of 85% ilmenite. Interlak offers the largest volume of heavy mineral sands, with grade upside potential, with grades in some areas estimated to be in excess of 70% ilmenite. The plan is to advance Moriusaq first given that its marine environment could provide an opportunity to employ dredging (a simple and low cost method) to exploit the sands.

Latest developments

Following the initial agreement to buy the stake in Bluejay in December 2015 FinnAust quickly got its plans together for developing the asset, with the strategy being to capitalise on Pituffik’s near term production potential. In February, results from a bathymetry (underwater) and seismic profiling survey completed in 2015, along with a sea floor sampling programme, suggested that the shallow marine environment hosts very large volumes of potentially high grade titanium, with the results multiplying the amount of known titanium mineralisation significantly.

Subsequently, various technical consultants were hired in order to complete fieldwork over the course of 2016, including an initial resource calculation for the Moriusaq target and surrounds. With the nights (and days) getting colder, the work programme was finished in September, with more than 500 drill holes having been completed along with trenching and sampling across the project area. Results confirmed that the two target areas will remain the key focus. An Environmental Impact Assessment has been completed and a Social Impact Assessment is underway.

FinnAust is now in a position where it expects to publish a JORC compliant resource by the end of 2016, ahead of commencing an initial 30,000 tonne proof-of-concept bulk sampling programme in 2017, followed by the application for an exploitation licence in Q1 2017.

So far so good but valuation is materially out of kilter with the progression stage

To give FinnAust management credit the company has, over the past ten months or so, provided a text book example of how to promote s story, and they have done so with a relatively limited freefloat. A plethora of technically worded RNS’s with copious amounts of “pleasing” and “exciteds” peppered throughout these releases in relation to the Pituffik asset has pushed the stock price up nearly 15 fold since the beginning of the year. The shares have risen from 0.55p just prior to the Bluejay acquisition announcement to the current 7.5p, making FinnAust one of the best performing shares on the whole of the London markets in the year to date.

All well and good but we have a number of issues and questions.

Difficulties mining in Greenland

As a jurisdiction, Greenland has its attractions and is regularly ranked as one of the most attractive places for mining investment by various industry surveys, accepted. The government is becoming ever more mining friendly as it looks to take advantage of the island’s rich resources and, in contrast to the locations of many AIM listed junior miners, the country is politically stable. As mentioned above, climate change is causing ice sheets to retreat, creating the opportunity to study new potential resources.

But there are many challenges related to operating a mine in Greenland, mainly due to the harsh climatic conditions and remote location.

At Pituffik itself the average daily temperature in July barely reaches 8°C, with the winter months typically seeing temperatures of around -20°C. This creates a situation where certain activities can only be carried out at certain times of the year and makes for a more expensive operating environment. With pack ice forming in the early autumn the window for making shipments from Pituffik could be as low as five months.

Infrastructure in the country as a whole is limited, with there being no major road networks and most domestic transportation being conducted by air – Pituffik is located c.30km from the international airport and deep-water port of Thule Air Base which is operated by the US Air Force to the south-east and Qaanaaq domestic airport to the north.

Issue over deferred consideration and options shares

As part of the Bluejay Mining acquisition it was agreed that 40,755,885 deferred shares be paid to the vendors upon the grant of a mineral exploration permit over the offshore Pituffik project area. This was subsequently granted in July this year and satisfied one of two terms for the issuance of the deferred shares.

However, the second term requires that the issuance does not trigger a mandatory offer for the company by the Bluejay vendors under Rule 9 of the Takeover Code – ie. if their stake goes over 30% they will have to bid for the whole company. This situation would have occurred had the shares been issued given the Bluejay vendors’ current holding in FinnAust, so the company is waiting until any Rule 9 obligation ceases to exist before the deferred shares are issued. This can only come if the vendors sell some of their holding or, in the more likely case, their combined stake is diluted by further share issues.

There is also a four year option to acquire the remaining 39.63% of Bluejay for £594,393, to be satisfied by the issue of 108,071,388 new FinnAust shares to the Bluejay vendors. Again the situation is similar here in that the option will not be exercised if it were to trigger a mandatory offer or would trigger a reverse takeover under AIM rules. We note the RNS of 4th October in which Rod McIllree makes the statement “The Company now intends to review the mechanics of moving to 100% ownership of BlueJAy Mining Ltd (and hence Pituffik)…” and believe that this will be the “tell” that in fact unseats the stock price. The easiest avenue is simply to place the stake due to Blue Jay with a third party. As we point out below however, with a market cap approaching £50m without a JORC estimate at this point and no clear path to infrastructure build out, our bear case hinges almost entirely on this point – that is we doubt that a third party will pay anywhere near the current market cap in cold hard cash (the acid test for the industry’s perception of true value) for Blue Jay’s shares that are due from Finnaust and would thus absolve the takeover trigger. Of course they could apply for a “whitewash” if no third party steps up but all this does (assuming it was granted) is push out the date required for a liquidity event for the stockholders whilst not addressing the continuing cash needs of the company.

As we illustrate below in addressing our valuation concerns we suspect that any deal to place FAM shares for Blue Jay (if this route is taken) will be at a material discount to the current stock price if done in cash and still so if part of a strategic investor swap (which is what Western Areas is of course supposed to be…).

Director backgrounds

We note that certain Finniest directors have, shall we say “interesting” histories. Rod McIllree was the founder of ASX listed uranium explorer Greenland Minerals and Energy and its Managing Director up until August 2014. Australian newspaper The Sydney Morning Herald reported on several issues with the company including questions over its ownership structure (see here http://www.smh.com.au/business/unravelling–the–greenland–minerals–web–20091008–gp0w.html) and the rapid dilution of shareholders via the issuance and exercise of options. In addition, it would appear that McIllree and fellow director Simon Cato sold stock into the market immediately after exercising options – see here http://www.smh.com.au/business/a–cold–front–for–greenland

minerals–ceo–20110523–1f0px.html and note in particular:

“In mid-April (2011) those two (Cato and McIllree), and Why brow, each received 4.4 million newly vested options. Earlier this month (May 2011), Cato and McIllree both announced that they had exercised some of their options, 1.55 million and 250,000 respectively, but their filings suggested that they must have sold them immediately because their total shareholdings remained unchanged.”

The share price performance of Greenland Minerals has been “erratic” to be polite– see chart below. But What Greenland Minerals has in common with FAM is that there was a concerted news blitz that increased the stock price materially before the company was laid low in large part due to the debt that was taken on. The problem with a heavily promoted bull story is that at some point the major stakeholders have to get out and if there is  not a liquidity event to provide this gravity always kicks in.

not a liquidity event to provide this gravity always kicks in.

We also point out that Greg Kuenzel, Non-Exec at Finniest, has a history of value destruction at AIM listed Noricum Gold where he is Managing Director. Since the company listed in December 2010 the shares have fallen from the IPO price of 4p to the current 0.12p after failing to prove a JORC resource at various projects.

We also add that we have posed a number of questions to Rod McIllree in relation to these points to which he has deigned to reply.

A mine of information from the 2016 results

While there was nothing really new in the company’s 2016 results regarding progress on the ground the P&L and balance sheet provided a wealth of information. It was revealed that cash as at 30th June stood at just £425,046, although this figure was boosted post period end by a £500,000 (preexpenses) placing. With monthly administrative costs being c.£52,500, and assuming placing fees of c.£25,000 we estimate that the current cash balance amounts to around £0.75 million. With this amounting to just over 1 year’s worth of admin costs there is clearly a placing ahead, we suspect in the first half of next year at the latest.

Non-participation of major shareholder in last 2 placings

Back to the placings… Finnaust has raised a total of £1.5 million since announcing the Bluejay acquisition – £1 million on 4th March at 2p per share and £0.5 million on 13th July at 5p per share. Our question is why has Western Areas, trumpeted as a cornerstone investor, not taken part in these placings? And why did it only put £100,000 into the original acquisition placing? While Takeover Code rules prevent Western Areas as a major shareholder (37.14%) from increasing its interest, we believe it could have at least maintained its holding noting that the Bluejay acquisition document states:

Following completion of the Placing and the Bluejay Acquisition, neither Western Areas nor the Bluejay Vendors will be able to increase their interests in the voting rights of the Company through or between a Rule 9 threshold without Panel consent.

Valuation

The main question here boils down to the valuation.

At the current share price of 7.5p the markets are valuing FinnAust equity at a shade over £37m million. But if we calculate the valuation using the fully diluted number of shares in issue (see table below) then we arrive at a figure of £49.6 million

| Current shares in issue | 494,400,804 |

| Options & warrants | 19,309,366 |

| Bluejay deferred consideration | 40,755,885 |

| Bluejay option | 108,071,388 |

| TOTAL | 662,537,443 |

While we do not deny that FinnAust’s assets have potential we firmly believe that a figure of approx £50 million is simply far too high given the company’s current stage of development.

Even a research note written by the company’s own broker, Optiva Securities, back in February admitted that valuing the company was “challenging” largely given the early stage nature of the operations. We quote:

“Given the early stage of the Pituffik project, limited exploration data and the fact that the deposit does not yet support a JORC-compliant mineral resource estimate, it is challenging to estimate a value for the project in its current stage, in our view.”

Here’s why we think the valuation is overheated.

- Pituffik remains a very early stage asset. As yet there is no JORC resource, an exploitation licence to apply for, social impact assessment to complete, inevitable future placings to complete for working capital and the all important project financing to be raised.

- Minimal asset backing on the balance sheet. Net assets amounted to £12.48 million as at 30th June, with most of these being in the form of £12.63 million worth of intangibles. These include £1.9 million attributed to the Pituffik licence. These values would have been hard tested by the auditors and is the first “tell” that the market cap is out of sync with the current stage of resource progression. Remember this value includes ALL the company’s assets too not just Pituffik.

- Stripping out the book value of the non-Pituffik assets as at 30th June 2016 (£10.7 million) from the current valuation reveals that the market is effectively valuing Pituffik, an asset that was valued by the Bluejay vendors themselves at just £1.5 million only 10 months ago, at approx £40 million (on a fully diluted basis). We question whether the work done since acquisition has justified this 26-fold increase in value.

- One valuation benchmark we can use is a November 2015 technical report compiled by consultants SRK which determined a valuation range of $0.6 million to $24 million for Pituffik based on a variety of variables. While the report excludes the offshore dredging element of the project we note that even the highest valuation of $24 million represents a value of just £18.4 million – less than half the fully diluted current market price.

- Another valuation benchmark comes from the recently announced £215 million acquisition of mineral sands producer Sierra Rutile by Iluka Resources. The deal was completed on a historic enterprise value/EBITDA multiple of 16.2 times. Assuming a build out cost to FinnAust of say c.$20 million (£15.4 million) gives an enterprise value for the company of approx £65 million. Applying the Sierra Rutile exit multiple thus means that FinnAust needs to be making annual EBITDA of c.£4 million to justify anywhere near the current valuation.

We believe Finnaust has been a text book example in how to release news to the market in relation to a potentially positive mining opportunity whilst simultaneously keeping the free float tight. A classic squeeze if you wish.

But, once sell orders start coming through, which we suspect they may do as private investors look to take profits or, more likely, any strategic investor puts a very different valuation on the company’s assets given their current stage, the tumble downward could be rapid. While the deal in Greenland with Capricorn/Cairn is not yet complete when it is, we suspect there will be another £500,000 worth of shares in the market looking to be sold – we doubt Cairn will be looking to hold on to the stock given they wanted to be out of the assets at such a low price and they are after all much more financially resourced than FAM to develop them if they so wished.

The fact is that, while many have made large paper profits on FinnAust, liquidity remains low and a value event is needed for those gains to be realised. If the company itself needs an exit, if it is overvalued the industry simply will not pay up.

Viva

Dan

ooh.. this looks EXACTLY like the ALIGN piece of research that has been taken down.. and the SHAREPROPHETS one.. that linked to the ALIGN bit of research, thats been taken down.

COME ON DAN.. post some of your original stuff thats got legs….. this copy and pasted shit from Align is VERY BAD for your credibility down here in sunny London!

Viva to Lapland ya’kunt!

OK Point taken.. Why don’t you write some thing up and I’ll publish it?

Dan

x