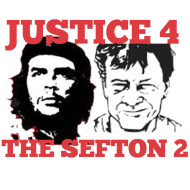

Not much happening in the Smallcaps Oil & Gas sector this week. Don’t forget to sign the e-petition demanding an investigation into Sefton Resources. Ellerton the fraud and perjurer has now been SACKED. Demand an investigation. Click the link

http://epetitions.direct.gov.uk/petitions/52766

Bridge Energy (LON: BRDG)

Updates on the current exploration drilling campaign, targeting the Amol and Asha East prospects within the PL457 licence. Further to the announcement on 14 August 2013, we can now advise that the operator has changed the order of drilling, with results from the Amol well now expected first. Bridge has a 20% interest in the PL457 licence. Wintershall is the operator with 40%, with the other partners VNG (20%) and E.ON (20%)

Chariot Oil & Gas (LON: CHAR)

The Brazilian National Agency of Petroleum, Natural Gas and Biofuel has approved and signed the concession agreement for Chariot’s 100% interest and operatorship in licences BAR-M-292, BAR-M-293, BAR-M-313 and BAR-M-314 in the Barreirinhas basin, offshore Brazil. Chariot’s successful bids for these blocks were detailed in the announcement of 15 May 2013. CHAR will now look to carry out an Environmental Impact Assessment with the aim of planning and implementing a 3D seismic programme across these blocks in 2014.

Falcon Oil & Gas (LON: FOG)

Released an operational update this week. Much too convoluted for the Smallcap round up. You can read it HERE

Forum Energy (LON: FEP)

The Directors of Forum Energy were forced to release a statement on the recent movement in the Company’s share price, (jumped by more than 53%) confirming that they are not aware of any reason for such a movement.

GeoPark (LON: GPK)

The Latin American oil and gas explorer, operator and consolidator with operations and production in Chile, Colombia, Brazil and Argentina announce its first half financial results ended 30 June 2013. Click HERE to read them

Kea Petroleum (LON: KEA)

Hit the skids this week. The the oil and gas company focused on New Zealand, announced further results of testing and flow rates at Puka, the decision not to renew the PEP51155 permit and the commencement of a strategic review process. Combined total flow rates at Puka 1 and Puka 2 have stabilised at approximately (a piss poor) 200 barrels of oil per day.

Madagascar Oil (LON: MOIL)

Released their half year results for the six month period ended 30 June 2013. Click HERE to read

Magnolia Petroleum (LON: MAGP)

Updated on its activities in proven US onshore formations, including its participation in four new wells in Oklahoma alongside established operators such as Devon Energy. This update is in line with the Company’s strategy to rapidly build production and reserves on its leases in oil rich formations including the Bakken in North Dakota and Mississippi Lime in Oklahoma. If you want to read Ritas’ guff click HERE

And the week wouldn’t be complete without an update of some sort from Max Petroleum (LON: MXP)Who have commenced drilling the BCHW-3 appraisal well in the Baichonas West Field on Block E using the Zhanros ZJ-20 rig. The well will be drilled to a total vertical depth of approximately 1,460 metres targeting Jurassic and Triassic reservoirs. The Company has also successfully reached the target depth at the UTS-13 appraisal well in the Uytas Field which is currently being logged. The logging results will be announced as part of the next drilling update.

Nostra Terra Oil & Gas (LON: NTOG)

Holds a judgment against Richfield for in excess of US$1,500,000, plus on-going interest, attorney’s fees, and costs of collection. Six Russell County, Kansas leases belonging to Richfield will be sold at a public auction conducted by the Russell County Sheriff on 12 September 2013. The net proceeds from the sale will be applied to the balance of the judgment. Three of the leases, which were the subject of the 1 July announcement, including two producing wells and one saltwater disposal well, were originally auctioned at a Sheriff’s sale on 27 June 2013. Subsequent to that auction, Nostra Terra voluntarily made the decision to set aside the sales in order for these leases to be auctioned together with three additional leases, with producing and non-producing wells that share the same saltwater disposal well. Nostra Terra also has a lien on all of Richfield’s real property assets in the State of Utah. On 18 July, 2013 Richfield announced they have increased their lease position from 10,562 acres to 15,375 acres in Central Utah. All of these leases are included in the assets liened by Nostra Terra. Auctions for these assets will be scheduled in order to satisfy the Judgment awarded to Nostra Terra. Further efforts to collect on the judgment, including garnishments, have been undertaken and will continue until the judgment is satisfied in full. Matt Lofgran, Chief Executive Officer of Nostra Terra, commented: “While Richfield has stated that they will ‘vigorously defend against this foreclosure action,’ the reality is that the foreclosure action has already progressed to judgment in favor of Nostra Terra. Nostra Terra will continue its vigorous effort to collect its judgment in full either through cash or assets.”

Petroceltic (LON: PCI)Has spudded two wells: Shakrok-1, the first well in its drilling campaign in the Kurdistan Region of Iraq and Cobalcescu South, part of its planned multi-well drilling campaign, offshore Romania.

Range Resources (LON: RRL)

Two bits of news this week. Range would like to draw attention to the announcement released by Citation Resources Limited (ASX:CTR) with respect to the Company’s interest in Guatemala. If you want to waste your time reading this then click HERE The other can be read HERE

Sefton Resources (LON: SER)

Trading in its shares had to be suspended on AIM due to the unauthorised publishing of confidential internal information on a website. What a pity. Here’s hoping they never come back. Good riddance to this POS.

Trading in its shares had to be suspended on AIM due to the unauthorised publishing of confidential internal information on a website. What a pity. Here’s hoping they never come back. Good riddance to this POS.

Sound Oil (LON: SOU)

Announced a positive well test at the onshore Nervesa discovery in Northern Italy. Hooray! The well test achieved a stabilised total gas flow rate of 2.7 MMscfd from multiple sandstone intervals in the Upper Miocene San Dona Formation using a dual string completion. Sound also confirms that, following a revision of its reservoir model for the full field, the P50 estimate of recoverable gas resources at Nervesa has increased from 21 Bcf (with an estimated NPV10 of US$58m) to 24 Bcf (with an estimated NPV10 of circa US$66m). Following these successful results, the Company will continue with its plans to: (i) apply for a Production Concession with a view to achieving first gas sales at Nervesa in 2015; (ii) drill a second well at Nervesa, addressing the Southern part of the structure; and (iii) secure a Reserve Based Lending (“facility to provide funding for the next stage of Sound Oil’s development;

In anticipation of securing an RBL facility, the Company has entered into an asset backed bridge loan facility for some £2.5 million with a syndicate of private investors. The Bridge Loan matures in February 2015, carries a coupon of 10% per annum and an average annual fee of 9%. It is the Company’s intention to repay the Bridge Loan with a portion of the proceeds from the RBL facility. The Company has also renewed its existing Standby Equity Distribution Agreement with Yorkville Advisors LLP for a period of three years on the pre-existing terms and without an upfront fee. Beyond Nervesa, the Company will continue with the second phase of its strategy, which includes preparing for 2014 drilling at Laura and Badile. The Company is pleased to invite investors to a conference call on 6th September 2013 at 1100. Details can be obtained from Annabelle Griffiths at A.Griffiths@soundoil.co.uk. James Parsons, Sound Oil’s Chief Executive Officer, commented: “This is a significant milestone for the Company”

Tower Resources (LON: TRP)

Provided an update on the acquisition of Wilton Petroleum. On 3 July 2013, Tower Resources announced the conditional acquisition of Wilton Petroleum, which owns a 20% carried interest in the Marovoay Block-2102, onshore Madagascar. The Block is operated by Ophir Madagascar Limited (80% interest). The Operator has indicated to Wilton that they do not now intend to drill the commitment well due to be drilled by 19 April 2014 and to which Wilton’s carry of $4million by Ophir related. Discussions between the parties are in progress and accordingly Tower has agreed with the Wilton Petroleum vendors to extend the completion date of the acquisition to 30 September 2013.

Union Jack Oil (LON: UJO)

Released unaudited results for the half year ended 30 June 2013. Highlights included The Acquisition of interests in four onshore Petroleum Exploration and Development Licences all containing drill ready prospects… Progress made towards delivering on strategy to rapidly appraise and exploit the acquired assets… Planning consent received in respect of the Burton on the Wolds-1 and Wressle-1 Prospects… A two well drilling programme covering Burton on the Wolds-1 and Wressle-1 scheduled for later this year. Gross proceeds of £800,000 in connection with Admission… Cash position in excess of £1.0 million as at 5 September 2013.

David Bramhill, Executive Chairman, commented: “In the space of just over one year Union Jack has obtained interests in four onshore UK drill ready prospects and will be involved in the drilling of the Burton on the Wolds-1 and Wressle-1 exploration wells during the next few months. Your Company has made significant progress during the first half of 2013 and I look forward to reporting on drill results and other matters in respect of the remaining period of the year in due course.”