Busy week for me personally with having to take two days out to attend The Royal Courts of Justice. All very exciting.

Busy week for me personally with having to take two days out to attend The Royal Courts of Justice. All very exciting.

Not much news other than the usual. Still a good read.

3Legs Resources (LON: 3LEG)

The struggling independent oil and gas group focusing on the exploration & development of unconventional oil and gas resources, released an operational update. You can read it HERE

GeoPark Holdings (LON: GPK)

Two RNS’s from the company this week . 1/ Successful testing of gas production from a previously untested formation in the Yagan Norte 4 well on the Fell Block in Chile. GeoPark operates and has a 100% working interest in the Fell Block. GeoPark carried out a production test in the Springhill formation, behind casing, in the Yagan Norte 4 well, at 3,005 metres for a period of 20 hours, which flowed at a rate of approximately 3.3 million standard cubic feet per day of gas through a choke of 12 millimetres, with a well head pressure of 1,208 pounds per square inch. Further production history will be required to determine a stabilized flow rate for the well. The Yagan Norte 4 well was originally drilled to a total depth of 3,105 metres and tested and produced oil from the Tobifera formation in an open hole section. GeoPark has interests in 27 exploration, development and production blocks in Colombia, Chile, Argentina and Brazil, subject to local regulatory approval. During 2013, GeoPark plans to carry out a total 35-45 well drilling program with an expected work program investment of US$200-230 million.

2/ Successful drilling, testing and putting into production of the Tarotaro 1 exploration well on the Llanos 34 Block in Colombia. GeoPark operates and has a 45% working interest in the Llanos 34 Block. GeoPark drilled and completed the Tarotaro 1 well to a total depth of 3,175 metres. A test conducted with an electrical submersible pump in the Guadalupe formation, at approximately 2,955 metres, resulted in a production rate of approximately 2,239 barrels of oil per day of 15.5 degrees API oil, with a 0.6% water. Further monitoring of production history will be required to determine stabilized flow rates and the extent of the reservoir.

Gulf Keystone Petroleum (LON: GKP)

Released their 2012 Annual Results. Which can be read by clicking HERE Earlier in the week they announced that Shaikan-7, the first deep exploration well on the Shaikan block, targeting the mid to lower Triassic and, potentially, Permian horizons, spudded late on Sunday 16 June 2013. The well is being drilled with the Weatherford Rig 319 (3000HP) close to the crest of the Shaikan structure, approximately 1km east of the Shaikan-1 discovery well. The well is planned to reach a total depth below 4,500m in the Permian and the drilling is expected to take about 9 months.

Ithaca Energy Inc. (LON: IAE)

Announces the commencement of development drilling operations on the Stella field, with the first well on the field having been spudded using the Ensco 100 heavy duty jack-up rig. The initial campaign involves the drilling and completion of four production wells on the Stella field prior to start-up. Three horizontal wells are to be drilled into the oil rim of the field, along with one highly deviated gas-condensate well on the crest of the structure. The Company has also executed a farm-out agreement with a subsidiary of Edison International SpA for a 25% interest in the licences containing the Handcross prospect and an agreement with Shell UK Limited concerning a licence awarded in the 27th UK Offshore Licensing Round.

Leni Gas & Oil (LON: LGO)

Released news this week on a Letter of Intent with Beach Oilfield Limited, a private Trinidadian registered company, regarding cross-assignment of interests in the Cedros Peninsula of south western Trinidad and Tobago. LGO and BOLT have agreed to work together to explore the deeper horizons below 7,000 feet in their respective acreage located in the south west of Trinidad. BOLT and LGO between them hold rights to over 7,200 gross acres of private petroleum leases which are already productive at shallow horizons; with existing production from the Icacos and Bonasse oilfields. The area is considered to contain a deeper Herrera Sandstone play that has been proven to be productive elsewhere in Trinidad. In the adjacent offshore Soldado area over 750 million barrels of oil have been discovered, however, the equivalent onshore trend is largely unexplored. LGO’s 100% owned private leases covering 1,750 acres in the Cedros, that are included in the arrangements, are currently awaiting the grant of a private petroleum licence by the Trinidad and Tobago Ministry of Energy and Energy Affairs.

Max Petroleum (LON: MXP)

Hooray. MXP have released some real news. The SAGW-4 appraisal well in the Sagiz West Field has reached a total vertical depth of 1,558 metres, indicating 20 metres of net hydrocarbon pay over a 62 metre interval from 1,222 to 1,284 metres. Pay intervals include 16 metres of gas condensate and four metres of oil. In addition, there is a further 17 metres of potential oil pay with lower oil saturation than normally seen in productive reservoirs in the basin that is situated above the oil-water contact at 1,284 metres. Reservoir quality is good, with porosities ranging from 15% to 25%. Production casing is being run in the well and testing of all potentially productive intervals will begin as soon as regulatory approvals are received. Results confirm that the Sagiz West Field extends four kilometres to the south of the existing productive well at SAGW-3. The Company has also completed drilling the UTS-8 appraisal well in the Uytas Field on Block A. The well reached a total depth of 875 metres without encountering producible hydrocarbons and will be plugged and abandoned. This well was drilled to test the possibility of a westward extension of the field. The well is located beyond the mapped limits of the Uytas Field, and current estimates of contingent resources will not be affected by the results from this well.The Zhanros ZJ-20 rig will now move on to drill the UTS-7 and UTS-9 appraisal wells in the Uytas Field, before returning to Block E. Of course Max being Max they reverted to type later in the week releasing a “naff” update. The weeks naffness? “It has commenced drilling the UTS-7 appraisal well in the Uytas Field on Block A using Zhanros ZJ-20 rig. The well will be drilled to a total vertical depth of 550 metres targeting Cretaceous and Jurassic reservoirs.” Next week Max will announce? Another drilling update!

New World Oil & Gas (LON: NEW)

Has secured a six-month extension in work programme commitment deadlines for Licences 1/09 and 2/09 at its Danica Jutland Project in Western Denmark. This extension was discussed with Danica Jutland ApS and the Danish North Sea Fund, the Company’s 20% full-paying partner, and approved by the Danish Energy Agency, and will allow the results of the recent acquisition of 3-D seismic survey and some soil geochemistry work over the Jensen prospects to be incorporated into a forward work programme on these licences. In addition to allowing New World more time to evaluate the 3-D data interpretation and the prospects defined by the survey, the extra six months will provide New World with more time to continue on-going discussions with potential farm-in partners. New World has completed the Danish licence obligations with regards to seismic acquisition. A total of 191 km of 2-D and 75 km2 of 3-D seismic has been acquired on the 1/09 and 2/09 licences and, as a result, New World currently holds a 25% working interest in these licences. Since acquiring the licences in 2011, the Company has commissioned and released a number of Competent Person’s Reports, identifying four drill-ready prospects in Denmark.

Nostra Terra Oil & Gas (LON: NTOG)

Shoots itself in the foot by raising £750,000 before expenses by way of another placing of 187,500,000 new ordinary shares of 0.1p each in the capital of the Company at 0.40 pence per new Ordinary Share. The Placing was undertaken with existing and new investors. The net proceeds of the Placing, arranged at a discount of 10% to the underlying share price at the time will be utilised in the drilling of further wells in the Oklahoma based Chisholm Trail Prospect with a portion going towards leasing in the High Plains Prospect in Texas. Total shares will increase to 2,776,211,610. The share price was down 0ver 8% at time of writing!

Ophir Energy (LON: OPHR)

Spud the Starfish-1 well in the Ophir operated Offshore Accra PSC. The Starfish-1 well is Ophir’s first well in Ghana and will be drilled by the Stena DrillMax drillship. The Starfish-1 well is located in water depths of 1,500m and has a target depth of 3,850m. The well is designed as a play-opener to test a stratigraphic onlap trap. Ophir’s Management estimates mean prospective resources of 292 MMBOE with a 20% chance of success for the Starfish prospect. The well is expected to require approximately 40-days to complete. Ophir operates the Offshore Accra PSC with a 20% equity position.

Rialto Energy ( LON: RIA)

Yet another company diluting share-holders. No wonder Patrick Garo has resigned from his role as Chief Financial Officer of the Company with immediate effect. When will it ever stop? Today? Tomorrow? Or never? RIA are raising up to £9.7 million by way of a placing of new ordinary shares of the Company to institutional and other investors. The Placing will be conducted by way of an accelerated bookbuild process whereby GMP Securities Europe LLP and Euroz Securities Limited will be acting as joint bookrunners. In addition, the Company intends to undertake a share purchase plan of up to A$5 million, where eligible shareholders resident in Australia and New Zealand will be given the opportunity to (Give us more money to piss away) subscribe for new ordinary shares up to a total investment of A$15,000 per shareholder. The net proceeds of the Placing will be used to further the exploration and development work already underway at the Company’s interests in Cote d’Ivoire.

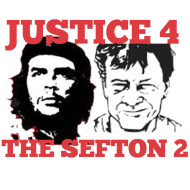

Sefton Resources (LON: SER)

Sefton Resources (LON: SER)

The corporate liars & fraudsters announced that all resolutions at the AGM were duly passed with approval in excess of 98%. Yet more deceit. No mention of how many shares were actually cast! Just how many bothered to vote let alone turn up for what will be their last AGM is known only to the jackals that run the company. As previously announced Arleth retired (cost cutting) from the Board at today’s AGM. Of course his TOP HAT pension will see him “all right jack” Good riddance to the rat leaving the stinking ship.

Silvermere Energy (LON; SLME)

Who are in default of significant outstanding financial commitments on its I-1 Well, Silvermere announces that it has received a demand notice from Dominion Production Company LLC, the operator of the I-1 Well, for full payment of amounts outstanding to them totalling $229,445.29 on or before 15 July 2013. The demand notice states that if these payment terms are not met then Silvermere’s interest in the 818-L Field will be sold by way of a public auction to the highest bidder on 6 August 2013. The Company remains in discussions with various parties with respect to refinancing the Company and a further announcement will be made as soon as practicable. Stay well away from this company.

SOCO International (LON: SIA)

announces that the exploration well TGT-10X, spudded on 20th June 2013. The well is located approximately six kilometres south of the H4 Well Head Platform, which is in the southern part of Block 16-1’s TGT Field in the Cuu Long Basin off the southern coast of Vietnam. The TGT-10X well is the first in a four well drilling programme to be conducted this year on the TGT field and will be drilled with the jack-up drilling rig Naga-2. The well is expected to take 25 to 30 days, with a planned depth of approximately 4,400 metres below mean sea level. Further updates will follow in due course.

Wentworth Resources ( LON: WRL)

Completes a US$10 million long-term debt facility. On 20 June 2013, the Company executed a US$10 million term loan facility that matures on 31 December 2017. The loan bears interest of 6 percent per annum with interest only payments prior to maturity. The lendor is Vitol Energy (Bermuda) Limited , a Vitol Group company. Vitol, a leading physical energy trading house, is also a shareholder of Wentworth. In combination with the loan, Vitol has been issued 5,000,000 share purchase warrants each exercisable into one common share of the Company on or before 31 December 2015 at an exercise price of US$1.24 per share. The proceeds from the loan will be used to repay the Company’s existing long-term loan from Tanzanian Investment Bank (approximately US$5.8 million, the “TIB Loan”) and to fund general working capital requirements. The TIB Loan bore interest of 9.18 percent per annum plus an annual agency fee of 0.5 percent. Geoff Bury, Managing Director, commented “This loan facility strengthens our balance sheet and our overall financial position and provides the resources and time necessary to complete a number of key milestones. We thank Vitol for their financial support and commitment and in the coming months we look forward to updating shareholders on our progress as we move through this important time for the Company. ”

What Gary isn’t saying is that their debt has now increased!

Xcite Energy (LON: XEL)

Awarded an aggregate of 9,850,000 options to purchase ordinary shares of the Company to the Board of Directors, and to certain members of the Xcite Energy Resources Limited Management team and staff. This award is made in recognition of the substantial upgrade in reserves, as announced by the Company in April 2013. All options have an exercise price of £1.01 per ordinary share and carry a term of five years from the date of award. Bit of an anomaly at the moment as at time of writing the XEL SP is 99.75P