Amerisur Resources (LON: AMER)

Amerisur Resources (LON: AMER)

Good news came from the company this week. The Platanillo-11 well has been completed in the U sand and produced at a controlled rate of 1,500 BOPD with trace water in natural flow. The well has now been placed on production at approximately 1,100 BOPD. While the Latco-01 rig was skidded onto the next slot within the 5S location and spudded well Platanillo-12. The well is currently at 2,662ft. Alea-1R ST1 has been placed on production, producing 700 BOPD at a controlled rate with 20% water cut, in line with expectations from the log interpretation.

The Serinco D-10 drilling rig has been moved over the Platanillo-2 well in the same location in order to side track it. Platanillo-2 will be sidetracked to a new position to the south of Pad A, a distance of approximately 3,400ft. The well is expected to take approximately 40 days to drill and log. (So far so good).

Logistical issues continue to constrain field production in Platanillo. However the Company’s efforts to develop alternative options are proving successful and the net impact of the constraint has been significantly reduced. Current field production is approximately 7,100 BOPD against a calculated production potential of 8,500 BOPD. Amerisur continues to develop further export routes, at attractive pricing, to further support the development of the field. Colombia – Interpretation of the newly acquired 2D seismic data continues. The Company expects to drill a further exploration well in Fenix this year. Paraguay A gravity survey has been initiated in the western blocks in Paraguay. This survey, of 500 high precision stations is being acquired in the prospection blocks in the Piriti-Pilar complex basin.

Dr. John Wardle, Chief Executive then went on to tell us all how super this was while all the while he and Nick were flogging stock at 48p per share and buying stock options at 7 pish and 0.1 pish! “We continue to be encouraged by successful results from the Platanillo field. We have now drilled 7 new wells and performed 2 sidetracks of legacy wells with a 100% success rate. This is a very strong endorsement of the geological model and bodes well for the wells to the north. With civil works on the northern road to Platform 3N commencing shortly I look forward to seeing further significant growth as we extend our reserves base beyond the strong results of Platanillo-1 side track. As we have already demonstrated, logistical issues can and will be addressed gradually to develop Platanillo to its full scale.”

On 6 June 2013 it issued a total of 19,250,000 new ordinary shares of 0.1p each pursuant to the exercise of options by Directors as follows: 5,500,000 2008 options at 7.525p each to fill your pockets Nick Harrison; and 10,000,000 2008 options at 7.525p each by Tracarta Limited, in which, Grab the cash, John Wardle has a beneficial interest; and 3,750,000 LTIP shares at 0.1p each by Tracarta Limited, in which, Grab some more cash, John Wardle has a beneficial interest. The number of shares in issue is now 1,056,518,831. On 6 June 2013, principally to cover the exercise costs and tax due on the options, in the Company’s shares: If you swallow that you’d swallow pig shit pie, Nick Harrison flogged 3,778,645 shares at 48p each trousering £181,000 pound while Tracarta Limited sold 5,221,355 shares on 6 June 2013 at 48p each trousering just over £250,000 pounds. Free money! And these people wonder why the markets are viewed as a cess-pit!

Chariot Oil & Gas (LON: CHAR)Confirms that the Ministry of Mines and Energy, Namibia has approved a one year extension to the First Renewal Period for Block 2714A, held in partnership with Petrobras Oil & Gas B.V.(30%) (Operator), BP (45%) and Chariot’s wholly owned subsidiary Enigma Oil and Gas (PTY) Ltd. (25%). The extension period will commence on 31 August 2013.

The extension of this First Renewal Phase will allow the partnership to complete its analysis of the drilling results of the Kabeljou-1 exploration well in order to progress the description of the rest of the prospectivity in the licence, allowing the partnership to take an informed decision on its forward plan for the block and its commitments for the next phase of development. The extension will also enable Chariot to evaluate and incorporate results from a third party well that is anticipated to take place in close proximity in Q3 2013.

Enegi Oil (LON: ENEG)

An independent oil and gas Company with a portfolio of assets located in the UK North Sea, Newfoundland Canada, Ireland, and Jordan, updates on its operations in western Newfoundland and, in particular, the GHF. A sustained production process has been established on the Well in GHF. As part of the process, which is still on-going and has been designed and implemented to gather additional performance data, the Well has been flowed at varying rates and intervals as per the testing programme.

In total, the Well has been flowed for a total of 214 hours since the sustained production process commenced in mid-March up until 17 May 2013. During this time, 3,099 barrels of fluid was produced with an average water cut of 44%, yielding 1,731 barrels of oil. As the Well continues to be flowed, and to clean up from the previous workover, there is potential that the water cut may reduce. Enegi also announced that another sales route has been secured for its produced oil, which is currently being sold at a premium to WTI. In addition, the Company has engaged an independent specialist production enhancement consultancy to advise on how the full potential of the Well can be unlocked.

The Company is pleased to announce that, after a detailed review and visit to the GHF site by the consultants, it has been advised by the consultants that sustained flow is possible with the installation of the correct artificial lift solution, and that, in the short-term, the best AFL solution is the installation of a jet pump. The reservoir inflow, water cut, and gas to liquid ratio will ultimately determine how much continuous production is achievable, however these parameters are currently uncertain and will only be ascertained through continuous production. The Company reports that the same production enhancement consultancy has offered to farm-in to GHF and EL1116. The Company is currently assessing the proposal; however, this reinforces the Company’s view of the potential of both GHF and EL1116.

The production data gathered to date continues to suggest there has been no reservoir pressure depletion and, in view of the result from the sustained production process, the Company believes it may be possible to book reserves on GHF. Based on results from the Well to date, the Company is pleased to report that it is working to finalise a suitable drilling programme for another well in GHF and may, if appropriate and subject to securing regulatory approval, accelerate development of GHF by proceeding straight to a drilling programme. The Company would look to bring in an appropriate partner in due course with a view to implementing this programme. The original horizontal well report from Petra Physics Ltd. in May 2007 indicated that a suitably targeted well can produce at a range of 474 bopd to 5,523 bopd

Falkland Oil & Gas (LON: FOGL)

The PGS M/V Ramform Sterling has completed a 3D seismic survey over the Cretaceous Fault Blocks within FOGL’s Southern Area Licences. A total of 1,018 square kilometres of full fold seismic data have been acquired. This survey was designed totarget a number of prospects and leads immediately to the west and north-west of the Darwin gas-condensate discovery. The survey was operated by Noble Energy on behalf of the Joint Venture, which also includes Edison International Spa. The survey was completed within budget. The data will now be processed by PGS and a fast track product will be available for interpretation in approximately two months. It is anticipated that the final processed data will be available in the fourth quarter of 2013. The fast track data will be used to commence prospect mapping and the selection of well locations. Third 3D survey. The Joint Venture expects to award a contract in the near future for a third 3D seismic survey that will be acquired in the northern licence area in the fourth quarter of 2013.

Frontera Resources (LON: FRR)

The independent oil and gas exploration and production company released an operations update for its holdings in the country of Georgia as well as its Greater Black Sea strategic initiative prior to the Company’s Annual General Meeting which was held yesterday at 10:00 AM Central Daylight Time at 3050 Post Oak Boulevard, 2nd Floor Conference Room, Houston, Texas 77056. You can view the OP by clicking HERE

GeoPark Holdings (LON: GPK)

Hit oil this week announcing the successful drilling, testing and putting into production of the new Potrillo 1 exploration well in the Yamu Block in the central Llanos basin in Colombia. GeoPark operates the Yamú Block. GeoPark drilled and completed the Potrillo 1 well to a total depth of 3,560 metres. A production test conducted with a jet pump in the Carbonera C7 formation, at approximately 3,014 metres, resulted in a production rate of approximately 650 barrels of oil per day of 33.0 API oil with an approximately 50% water cut. Further production history will be required to determine stabilized flow rates and the extent of the reservoir. Surface facilities are already in place and the produced crude oil is now being marketed and sold.

Jubilant Energy (LON: JUB)

Said this week that subsequent to the successful conventional testing in the Middle Bhuban formation in the North Atharamura-1 well in Tripura Block AA-ONN-2002/1, a Notice of Discovery has been submitted to the Management Committee of the Block and Government of India, as required by the Production Sharing Contract. North Atharamura-1 is the second exploratory well of the two well Phase-II minimum work programme for the Block. The well was spud on 12 February 2013 and reached a MD of 3,400 metres on 17 May 2013.

Based on the available information from drilling, two Objects were selected for conventional testing to establish the presence of producible Non-Associated Natural Gas. The gross Middle Bhuban sand package in the 610-635 metres MD interval (Object-II: perforated zone – 610-625 metres) appeared promising on the logging-while-drilling logs and the presence of hydrocarbons was further validated by wire-line logs. The testing operation for Object-II commenced on 29 May 2013 and the same was perforated on 31 May 2013. Object-II flowed gas at a measured rate of 1.7 million standard cubic feet per day at 24/64″ choke size. The multi-bean Study for flow rate and the Reservoir Limit Tests are currently being conducted. Jubilant holds a 20% participating interest in this block through its subsidiary Jubilant Oil & Gas Private Limited, India which is also the Operator for the block. GAIL India Limited holds the remaining 80% participating interest.

Lochard Energy (LON: LHD)

Released an Operational update and updated on the offer by The Parkmead Group (LON: PMG) Copies of the release can be viewed on the London Stock Exchange by clicking HERE

Magnolia Petroleum (LON: MAGP)

Yawnnnnnnnnnnnn! Read it HERE

Mediterranean Oil & Gas (LON: MOG)

Further to its announcement on the 6th September 2012, MOG advises that the Company’s subsidiary, Medoilgas Italia SpA has completed the transfer of its working interest in the 13 non-core exploration and production gas assets onshore Italy to Canoel International Energy Limited (TSXV:CIL) and that the sale is now unconditional. The transaction will be deemed complete once the decreed from the Ministry of Economical Development is recorded in the Italian Official Gazette.

Nighthawk Energy (LON: HAWK)

Now here’s a company that’s bringing home some bacon. US focused Nighthawk announced an update on the drilling and development of the Arikaree Creek oilfield at its 100% controlled and operated Smoky Hill project in the Denver-Julesburg Basin, Colorado. Highlights are; Logging and coring of the Taos 1-10 well has identified an oil column in the Mississippian Spergen formation consistent with discoveries at Steamboat Hansen 8-10 and Big Sky 4-11 wells… Testing and completion of the Taos 1-10 well is underway… The drilling rig has been retained to immediately drill two further Arikaree Creek appraisal wells, the Silverton 16-10 and the Snowbird 9-15 wells… Convertible loan notes to the value of £3.8 million (US$5.8 million) have been issued to fund additional drilling and development costs. Keep up the good work.

Nostra Terra Oil & Gas (LON: NTOG)

Released their 2012 annuals today reporting a pretax loss of 840 thousand pounds for the year ended 31 December 2012, compared to a loss of 996 thousand pounds last year. Loss per share was 0.039 pence, compared to a loss of 0.056 pence prior year. Revenue increased to 352 thousand pounds from 244 thousand pounds last year. The company said it kept a tight control on administrative expenses, which decreased by 6% to 876 thousand pounds. This contributed to a reduced loss before tax. Looking forward, the company said it will continue to minimise overheads and remain focused on growing production throughout the year. The NTOG AGM is 11.00am on 28 June 2013 at The Library, Travellers Club, 106 Pall Mall, London SW1Y 5EP.

Petroceltic (LON: PCI)

Mr Con Casey, a non-executive director, has informed the Company of his decision to retire from the board with immediate effect. Mr Casey had served as a director of Petroceltic since October 2000.

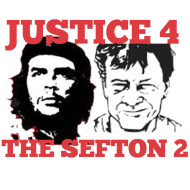

Sefton Resources (LON: SE)

More Kansas piss came this week. Any one interested? Click HERE