It’s full steam ahead towards the rocks for Sefton Resources as the company released yet another corker of an RNS YESTERDAY.

It’s full steam ahead towards the rocks for Sefton Resources as the company released yet another corker of an RNS YESTERDAY.

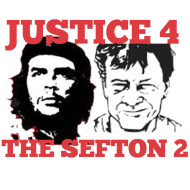

Man overboard at Sefton Resources. CEO & El Presidente Karl Arleth throws in the towel. Yes Karl has decided not to seek “re-election” (Resigned) at next months June AGM. Thus saving cash critical Sefton approx’ $400,000 dollars per year, give or take the odd $130,000 dollars in “consultancy fees”. Of course Sefton would have us all believe that Karl’s “retirement by rotation” is to “focus on his other business activities”. It has nothing to do with Jim cracking the whip in-order to conserve the ever dwindling cash critical position. Throw out the ballast (Dead wood)

Yesterdays news was in effect another duffers attempt to kick-start the sp ahead of the next passing round of the hat. You can always tell when Jim is after your money he starts trumpeting news about CPR’s, a sure sign that there’s another dilution on the way! You can bet your bottom dollar that yet again Hawaii Jim will be passing the hat around. Not exactly sure of how many placings there’s actually been but it’s over 30! All were preceded by Jims’, as it’s known in the trade, bullshit.

Back to yesterdays RNS. We get to know what exactly? Well nothing. Jim’s still shouting from the rooftops that his CPRs’ & PV10’s are the best in the business although on closer inspection it looks like some-one or some regulatory organisation may have had a quiet word in Jim’s shell-like (Ear).

Ear lugs burning Jim? Yes a closer inspection reveals that recent RNS’s have been altered omitting Jim’s Fantastical PV10 Figures. RNS’s do not now contain the words “Sefton sic> are valued by independent experts to have a PV(10) of $278 million (approximately £185 million) based on its assets as at the end of December 2011″ Gone forever are those immortal words which have given me many a chortle. In Aprils’ RNS this has been altered to; “Sefton has a market capitalisation of approximately £3.2 million and a dramatically higher unrisked PV(10) proved reserves and unproved resources value.”

Which in yesterdays May 15 ham fisted RNS effort to kick start the sp pre-yet another placing reads; “Currently Sefton has a market capitalisation of approximately £3.1 million and a higher PV(10) value for its unrisked proved reserves and unproved resources”. Pedants out there may want to note that the word “Dramatically” has been removed. Maybe it’s a typo?

I’ve also noticed that the deliberately mis-leading “provisional” bopd figures which were brought in to try to extricate themselves from the bopd lies that the respected City of London financial journalist, Tom Winnifrith exposed last year have now also gone. No more talk of “bottom tank sediments, non-saleable fluids & Jimbos’ shrinkage”. This covering excuse has now run it’s course. We just get the actual DOGGR figures for April which are as ever piss poor. 3874 barrels or 129 bopd. The cost of extraction yet again exceeds the return! Joke. Not to worry Jimbo’s got a plan. Goalposts.

Sefton are moving them (yet again) on drilling the proposed Hartje #21 replacement water disposal well. “Management is also investigating alternatives to drilling a replacement disposal well by making use of under-utilized wells on neighboring properties”

Sefton are moving them (yet again) on drilling the proposed Hartje #21 replacement water disposal well. “Management is also investigating alternatives to drilling a replacement disposal well by making use of under-utilized wells on neighboring properties”

Draw your own conclusions as to the excuse trotted out by Jimbo 5th March RNS, that “With the completion of the thermal stimulation report pending, the Board plan to review the findings of this report ahead of drilling any new wells (the Hartje #21 new water disposal well and the Hartje #20 new development oil well etc), so that they can be incorporated into a more comprehensive development plan”

Of course we all know that the initial position trotted out by Jimbo on Feb 15 2013 that; “The Company has completed the permitting for the drilling of the new water disposal well Hartje #21. A rig has been located that is available in March 2013 and negotiations on the drilling contract are proceeding.” was to put it bluntly ramping bullshit ahead of the March placing. Talk about a volte-face! Now Jim’s floating the idea that looking for an abandoned well nearby to dump his water is an option. As I said, “goalposts are on the move yet again and cash is critical”. As for the second steam generator I’ve heard this one so many times that I just now ignore it.

Poor Dr Ali openly blamed by Jimbo for the many delays at the disastrous Oct 2012 Miningmaven rampastic presentation gets yet another mention in dispatches. In what is euphemistically entitled “Progress Report #10” . The longest ever awaited Steamflood report in world history still hasn’t been completed. We are now being told that Dr Ali “will provide the parameters for an intermediate cyclic steaming stage with specifications for the building of a second steam generator.” So the get out of jail card for the no funding for the full Steamflood still not released 3 years too late report is the floating of an “Intermediate cyclic steaming stage” As for the second steam generator I’ve heard this one so many times that I just now ignore it. Where have I heard that before?

Dr Ali does “believe that the volumes and rates of steam being injected are too small to maximize oil production.” So the answer is as ever “More Steam!” I have heard this line many times in “Carry On Films” which leads me nicely on to the Jim’s often quoted Denver Colorado based grandly titled Reed W. Ferrill & Associates, Incorporated. Competent Persons Report.

The Sefton Proved Reserves (P1) of 3.5 million barrels of oil at 31 December 2012 in California. This reserve figure is viewed as “conservative” by Jimbo. Of course the fact that it’s gone down by 300,000 barrels doesn’t seem to concern Jimbo. So lets have a quick butchers at them. The present value of the estimated future net cash flows from these “Proved Reserves” (P1) before income taxes using a 10% discount rate (PV10) was calculated to be US$107.4 million.

In his analysis the Denver Colorado based grandly titled Reed W. Ferrill & Associates, Incorporated calculated reserves from recovering 50% of original oil in place (OOIP). And just where does the Denver Colorado based grandly titled Reed W. Ferrill & Associates, Incorporated of 3020 JOYCE WAY STE 100 Golden, Colorado, United States get this 50% recovery figure from? Why it comes from the as yet never seen the light of day still unpublished 3 years too little to late Steamflood report. Yes from Dr Ali’s initial study (October 2010). Forget the fact that Sefton have never in 13 years ever produced 50% of anything. Tapia oil comes from Stripper wells. Wells which are nearing the end of their economic life. Back to the 3.5 million barrels based on a report that has still not after 3 years seen the light of day.

Denver Colorado based grandly titled. Reed W. Ferrill & Associates, Incorporated of 3020 JOYCE WAY STE 100 Golden, Colorado, United States stated in 2011 that Proven resources were 3.738 million barrels they’re now saying that December 2012’s Proven Resources is actually about 8% less at 3.5 million barrels. Always read the small print.

The 2012 Proved Developed figure of 1,360,000 barrels has gone down by 300,000 thousand barrels from the 2011 CPR. Now for the life of me Sefton produced 42,000 barrels in 2012. So where has 258,000 thousand barrels gone? Sefton tell us that “year-end 2011 shows a reduction in both proven reserves and the PV10 valuation at year-end 2012. These reductions result from production in 2012 not being replaced, together with cost increases associated with cyclic steaming and other production-related items, the effect of which has reduced economic life and therefore reserve recovery.” It’s all smoke and mirrors.

The present net value of $107 million dollars is laughable. $68,000,000 million dollars of that is based on PUD, Proved Undeveloped which means that huge amounts of money needs to be invested to realise these grossly over-inflated production estimates which are based on a 50% recovery factored in from an initial sounding from Dr Ali in 2010! It is ridiculous. Jimbo Ellerton keeps paying for so called “Independent CPR’s” these ridiculous numbers are over 60% of the Tapia Undeveloped proved resources. They can not be realised by Sefton because quite simply it is based on a hypothesis of 50% recovery from a report that needs $50/$70 million dollars to fully implement!

What we have here is yet another attempt by Jimbo to RE-trumpet the false dawns. Now turning to the World famous Reed W. Ferrill & Associates, Incorporated of 3020 JOYCE WAY STE 100 Golden, Colorado, United States

Here’s a multiple choice question. Answers supplied.

Reed W. Ferrill & Associates, Incorporated of 3020 JOYCE WAY STE 100 Golden, Colorado, United States

1/ Who are these people? Answer. Person in the singular.

2/ Where do they work from? Answer. A 4 Bedroomed house

3/ Where’s their offices? Answer HERE

Take a good look you may just be able to see Reed W. or one of his “Associates” peeping out of his bedroom window. Oops sorry I meant Swanky Denver office.

What address does Sefton Resources list the company as? Reed W. Ferrill & Associates, 3020 Joyce Way, Suite 100, Golden, Co 80401. Click HERE You’ll note the word “Suite 100”

Remember campers that all is not what Jimbo would have you believe!

Daniel Levi.