Busy week for the BMD site. Tip! News from Nostra?

Busy week for the BMD site. Tip! News from Nostra?

Bowleven (LON: BLVN)

Following assessment of the IM-5 well data, including logs, fluid samples, revised depth conversion and structure mapping, Bowleven, the Africa focused oil and gas exploration group traded on AIM, is pleased to announce a substantial increase to the Isongo Marine field (IM) in-place hydrocarbon volumes. You can read the full RNS by clicking HERE

Bridge Energy (LON: BRDG)

Said today that, as a 20% licence partner in PL457 containing the Asha discovery, it has signed an agreement regarding the co-ordination and joint development of PL001B and PL457 Asha discovery. The Agreement establishes an approach towards unitisation of the discoveries, with this process expected to be concluded latest mid-2014. On the basis of this Agreement, the Asha discovery will form an integral part of the proposed Ivar Aasen field development going forward. The Agreement has been approved by all relevant licence holders and remains subject to execution by the parties, which is expected to be concluded imminently.

Cadogan Petroleum (LON: CAD)

Cadogan announces that the sum of just over US$21,000,000 (“Judgment Debt”), which was required to be paid by Monday 4 March 2013, has not yet been received. Cadogan is in discussions with Global Process Systems regarding both the Judgment Debt and the potential further damages payable by GPS to Cadogan and a further announcement will be made on this if and when appropriate. In the meantime, interest on the Judgment Debt will accrue at a rate of 8% per annum equivalent to approximately US$4,600 per day.

Edge Resources (LON: EDG)

Has spudded the second well of the Company’s spring drilling programme in Primate, Saskatchewan. This second well is targeting a new oil horizon approximately 50 meters shallower than previously targeted zones in the area. This shallower zone has produced abundantly in both Alberta and Saskatchewan. Edge will be utilising conventional, horizontal drilling techniques to enhance production and ultimate recovery from this new horizon. Because of the very high reservoir permeability, the well will not require any stimulation or fracturing techniques; thereby, minimizing capital requirements. Based on the Company’s extensive base of proprietary 3D seismic, this second well is a test into a proven reservoir that (i) is easily identified on 3D seismic, (ii) has previously produced noteworthy, commercial oil volumes from vertical wells less than one hundred meters away and (iii) has successfully produced more than 100,000 barrels of oil per well, when drilled by a major E&P company nearby utilising the same technique.

Egdon Resources (LON: EDR)

Said this week that it has reached agreement in respect of farm-outs in Petroleum Exploration and Development Licences PEDL253 and PEDL241 to Union Jack Oil plc. Additionally, Egdon and Union Jack have signed a Letter of Intent whereby Union Jack has been granted an option to acquire a 10% interest in the North Somercotes Prospect in PEDL005R and a further 5% interest in PEDL241 from Egdon. The transfer of interests is subject to approval by the Department of Energy and Climate Change.

Magnolia Petroleum (LON: MAGP)

Reports an update on its activities in proven US onshore formations including the Bakken/Three Forks Sanish, North Dakota and the Mississippi Lime in Oklahoma. You can read the report by clicking HERE. Suffice it to say still NO Production figures from Rita.

New World Oil & Gas (LON: NEW)

Said that the Danish Energy Authority, part of the Government of Denmark, has formally approved the assignment to New World’s wholly owned subsidiary, New World Jutland ApS, an additional 12.5% working interest in Licences 1/09 and 2/09 of the Danica Jutland Project. Accordingly, the Company’s working interest in Danica Jutland has increased to 25%.

Nostra Terra (LON: NTOG)

The feisty tiddler updated on the Richfield Oil & Gas Company Note. On 14 April 2011 Richfield (formerly Hewitt Energy Group, Inc.) issued to the Company a US$1.3 million secured loan note which has been accruing interest at 10% per annum from the date of issue and which matured on 31 January 2012. The Note is secured against certain producing leases located in Kansas and certain non-producing leases located in Utah. Nostra Terra has been operating some of the producing leases in Kansas during the foreclosure process. On 1 February 2012, Nostra Terra began foreclosing on the Note and a hearing took place on 1 March 2013 on Nostra Terra’s motion for partial summary judgment. The Motion went unopposed. The court has directed Nostra Terra’s counsel to prepare an order granting the Motion and granting judgment in favour of the Company on its claims, which is expected to be on file later this month. The judgment will award Nostra in excess of US$1,500,000 in principal and interest, plus an additional amount to be determined to cover the costs of collection. Well Done Matt.

President Energy (LON: PPC)

Released an update on its operations in Argentina. The Highlights of which were; Seismic reprocessing and interpretation completed… Significant undrilled highs identified in proven field areas… STOIIP up by 215% in the Pozo Escondido Field from 20MMB to 63 MMB… Validates management views of the material upside for oil recovery… Field operations for fracs due to commence shortly

Range Resources (LON: RRL)

Some much needed financial good news came today from Pete Landaus’ Range Resources. An update with respect to the Company’s Trinidad operations with the following highlights: Morne Diablo and South Quarry licenses extended for an additional ten year period; 3,000 acres added to the east of the existing Morne Diablo…license, extending current Lower Forest development trend while adding potential for other, deeper targets; Enhanced Royalty reduced from previous farm out agreements – net back increased to $40 / bbl based on 1,000 bopd increasing to $50 on 2,000 bopd; and Finalisation of US$35m Debt Financing Facility.

Roxi Petroleum (LON: RXP)

The Central Asian oil and gas company with a focus on Kazakhstan, updated the market with developments at its Galaz asset. Well NK-12 was spudded on 23 November 2012 at Roxi’s NW Konys asset (Galaz), where Roxi has a 34.22% interest. On 2 March 2013, testing commenced on Well NK-12 at an interval in the Cretaceous zone where oil flowed at a rate of 117 bopd using an 8mm choke. Clive Carver, Chairman, commented: “We are pleased to report another successful well at Galaz. Once NK-12 is fully operational we expect gross production from the Galaz Contract Area alone to be more than 1,400 bopd and gross production from all of Roxi’s assets to be 1,800 bopd with 870 bopd net to Roxi”.

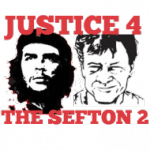

Sefton Resources (LON: SER)

More misery came this week for holders of Sefton stock as the company further diluted their investors.  Ellerton said “In order to maintain the momentum that has been gained at the Company’s Kansas operations, the Company has today raised a gross amount of £650,000 through a placing of 108,333,333 Common Shares at 0.6 pence per Common Share” Just what “Momentum” Ellertons’ talking about remains a mystery. The share price has cratered by over 99.7% since 2001. This placing brings up a 6000% dilution since the company listed in 2000. Horrific

Ellerton said “In order to maintain the momentum that has been gained at the Company’s Kansas operations, the Company has today raised a gross amount of £650,000 through a placing of 108,333,333 Common Shares at 0.6 pence per Common Share” Just what “Momentum” Ellertons’ talking about remains a mystery. The share price has cratered by over 99.7% since 2001. This placing brings up a 6000% dilution since the company listed in 2000. Horrific

Serica Energy (LON: SQZ)

Released news this week on the issue of tender documents for development of the North Sea Columbus field. The Field Development Plan provides for the supply of 51.3 million cubic feet of gas per day at peak to the UK gas market and 3,600 barrels per day of condensate and natural gas liquids (NGLs) with the recovery of proven and probable reserves estimated at 78 billion cubic feet of gas and 4.8 million barrels of condensate and NGLs. The company said that the planned development of the Columbus field was a significant step for Serica. Tender documents are being issued to pre-qualified contractors for the fabrication, installation and hook-up of subsea facilities and for the provision of associated subsea equipment and systems. Field development is scheduled to commence in 2H2013 with first production targeted for the summer of 2015.

Silvermere Energy (LON: SLME)

Confirms further progress on production and sales of oil and gas during February 2013 from the I-1 well on its Mustang Island 818-L Field. This is based on information provided by the Operator, Dominion Production Company LLC. Total production and sales of gas recorded during the month were 11,477,000 standard cubic feet, an increase of 32% month to month and total production of oil was 1,845 barrels, an increase of 4% month to month (1,912,068 scf and 308 barrels, respectively, net to Silvermere). The well was flowing for 73% of the time in February, representing a significant improvement on the previous month. Flow rates were restricted at times due to partial obstruction of the choke with drilling mud and debris as the well clean-up continued. When unrestricted by mud and debris, the well flowed at typical values of 700,000 scfpd and 155 bopd with a tubing head pressure of 2700 psi, in line with previous guidance. Oil produced during January and February has not yet reached the shore installation and sales meters due to slow flow rates in the 20″ line at the high pipeline operating pressure. The operator has advised that it intends to reduce pipeline operating pressure to increase flow velocities in the pipeline and thereby to deliver first oil sales. Silvermere owns a 16.66% working interest in the I-1 well and a 33.33% working interest in future wells on the leases.

Solo Oil (LON: SOLO)

Raised £1.0 million gross proceeds through the issue of 200 million new ordinary shares of 0.01p each in the Company at a price of 0.5 pence per share to institutional investors.

Spitfire Oil (LON: SRO)

Publish its unaudited interim results for the six months ended 31st December 2012. Spitfire and its subsidiaries recorded a loss before tax for the six months ended 31st December 2012 of A$182,907 (2011: A$211,889). With cash balances of A$7.2m, the Group has benefited from interest receipts of A$122,584 (2011 A$180,660) in the period. Operating costs have been reduced to A$305,491 (2011 A$392,549) with action taken during the period to further reduce costs, including a reduction in directors’ fees. Nice to see some integrity here.

TomCo Energy PLC (LON: TOM)

The oil shale exploration and development company focused on using innovative technology to unlock unconventional hydrocarbon resources, raised £1.781 million before expenses through a share placing by Fox-Davies Capital Limited, conditional on admission, of 148,406,526 new ordinary shares of 0.5 pence each at a price of 1.2 pence per share. The Placing was supported by a number of new financial institutions as well as other existing shareholders, including Altima Global Special Situations Master Fund Ltd. The proceeds from the Placing are to be used by TomCo for advancing permitting required for commercial production at the Company’s Holliday project, and for general working capital purposes.

Tower Resources (LON: TRP)

Announced that Andrew Matharu is joining the Company as Vice President Corporate Affairs on 11 March 2013. Andrew, 43, joins from Westhouse Securities, where he was Head of Oil & Gas and focussed on the small and mid-cap E&P sector. He has over 17 years’ experience in the oil and gas sector and commenced his career as a Petroleum Engineer with Chevron and Kerr-McGee.

Valiant Petroleum (LON: VPP)

Has signed a farm-out agreement with Maersk Oil North Sea UK Limited with regard to its Isabella prospect located in the UK Central North Sea Blocks 30/6b, 30/11a & 30/12d (P1820). Under the terms of the agreement, Valiant’s well costs will be partially carried by Maersk Oil UK subject to a cap on the promoted costs. Maersk Oil UK will also refund to Valiant certain historic costs associated with the licence at its working interest. Following completion, Valiant’s stake will reduce to 20% from its current 50% interest. The transaction remains subject to DECC consent. Isabella is a gas condensate prospect located on one of the largest undrilled fault blocks in the UK Central North Sea with prospectivity across multiple geological horizons.