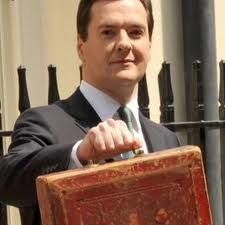

The key points outlined by Chancellor George Osborne in his Budget statement to the House of Commons: Today.

The key points outlined by Chancellor George Osborne in his Budget statement to the House of Commons: Today.

:: He concludes by saying: “This country borrowed its way into trouble, now it’s going to earn its way out”.

:: Raising the tax threshold will mean two million people will be taken out of tax altogether. “24 million who earn less than £100,000 will gain from this measure,” he said.

:: He pledges “the largest ever increase in the personal allowance”, increasing the income tax threshold by £1,100 from April 2013 to £9,205

:: Child benefit to be withdrawn from families where one parent earns more than £60,000. Some 90% of families will retain their child benefit, he said.

:: “All sections of society must make a contribution to dealing with the deficit.”

:: OBR says “reducing [top] tax rate is reasonable”

:: The top rate of tax will be reduced to 45p from April next year. Talking about the 50p rate that will be abolished he added: “No chancellor can justify a tax rate that raises next to nothing and damages our economy.”

:: “We’ve capped benefits, now it is right to cap tax reliefs too.”

:: 50p tax rate has “caused massive distortions”.

He said: “This tax rate is the highest in the G20.

“It is higher not just than the tax rate of America but also of major European countries like France, Italy, and Germany.

“It is widely acknowledged by business organisations and international observers as harming the British economy.”

:: No change to pension relief for higher tax payers

:: Stamp duty on properties over £2m is going to increase to 7% from tonight

:: Vehicle excise duty is being frozen for hauliers

:: Fuel duty – the planned 3p rise in August is not going to be scrapped

:: Online gambling – a tax is to be introduced based on where the customer is

:: Duty on tobacco to rise by 5% above inflation from tonight, putting up a packet of cigarettes by 37p. He says this will discourage people from smoking.

:: Alcohol duty: the government will shortly publish its strategy on alcohol pricing but today there are no further changes to the rate

:: VAT exemptions to remain on food clothes and books

:: Corporation tax to be cut by an additional 1% this April. It will be set at 22% by 2014.

:: Osborne: We want a competitive business tax – there will be tax credits for businesses

:: Some 20 million people are to receive a new tax statement outlining how their money is spent

:: The basic state pension will rise by £5.30 a week

:: There will be an automatic review of the state pension age

:: Pledging a far simpler tax system he says one million low paid people have been taken out of tax. He said we want “a modern tax system for the modern world”.

The Government is moving forward with a plan to integrate income tax with National Insurance and will also address loopholes int he VAT system, he said.

:: Public sector pay will be “more responsive” to local situations

:: Sunday trading rules to be relaxed for 8 weeks over the summer

:: Planning regulations are to be overhauled – a national framework will be published next week. “There will be a presumption in favour of sustainable development,” he said.

:: He wants the fastest broadband for 90% of the UK and the best technology infrastructure

:: There will be a new fund for TV production and video games

:: Mr Osborne wants to turn Britain into Europe’s ‘digital centre’

:: There will also be significant investment in the medicines and drugs sector – £100m support for new research

:: There will be a huge boost for investment in the North Sea, including a £3bn new field allowance for large and deep fields to open up West of Shetland

:: Renewables to play crucial part in the UK

:: There is to be more investment in London transport

:: Roads, railways, clean energy and broadband networks will be prioritised by the National Infrastructure Plan

:: Plans to pass on low interest rates to small businesses through the National Loan Guarantee Scheme are confirmed

:: The Government will give an extra £100m for armed forces housing and 100% relief on council tax for armed forces overseas

:: The cost of operations in Afghanistan is £2.4bn lower than planned

:: Osborne: ‘There will be no deficit financed giveaways in this Budget’

:: The growth forecast for 2013 has been revised down by 0.1% to 2%

:: The OBR has revised up UK economic growth from 0.7% to 0.8% for this year

:: The OBR expects the UK to avoid recession in 2012

:: The Office for Budget Responsibility has revised eurozone growth down to -0.3%

Good summery, many thanks for it BMD.com

“Good summary” lets hope it continues to get summery!