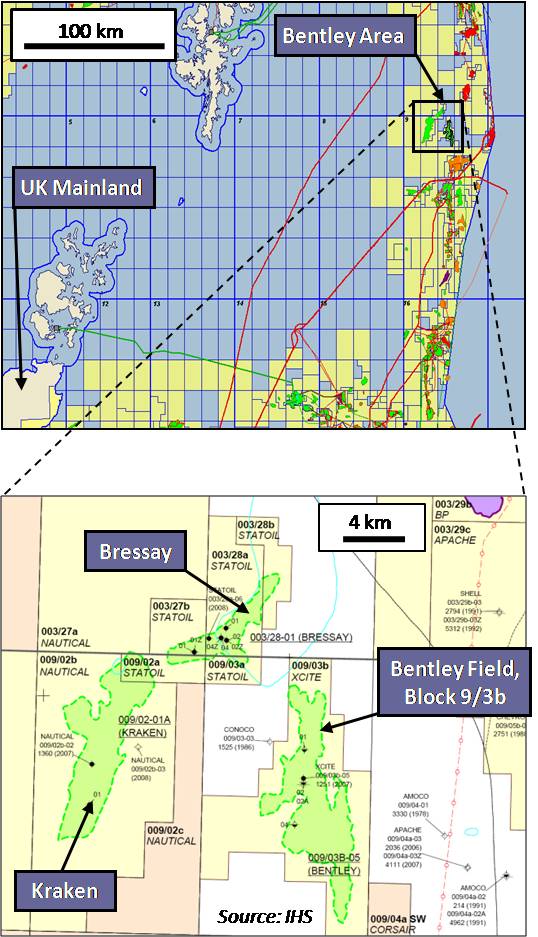

I’ve been looking at this oil play now for the past week due to the proximity of the drill to Kraken and Bressay. {not to mention the many, many requests for information from the blogship)

The stock was trading at approx’ 40p in early March 2010 and has since steadily risen the closer they get to the Bentley field drill. Currently at 88p, there is a fascinating similarity here with Encore and Nautical who both had a similar drill in the North Sea and we all know what has happened there! Phenomenal gains with much more to come. There are varying schools of thought here as to the value of the Bentley discovery which range from approx’ 130p right up to 650p depending on which Broker note you read. There’s no doubt that there is oil down there the problem is its viscosity ie,heavy oil. Heavy oil is always traded at a discount to the current oil price and this type of oil is certainly more difficult to bring to the surface. But and here’s the crucial pointer heavy oil is currently beingdrilled/extracted on the CPE 6 block in Colombia’s Llanos basin in fact this type of oil is routinely being discovered and extracted in South America,China and Eastern Europe; proving that the technology used on the drill has and is evolving successfully.

As your all aware there is a greater than 70% success being touted by Xcite Energy but……. and here is the crunch; Xcite are known generally and in my opinion to be erring on the side of caution as evidenced by the companies broker Arbuthnot’s 133p rating! Which seems to be way out given the known facts. One of which is that Xcite own 10 0% of the discovery.

0% of the discovery.

Get this company on a stock watch before the dogs of war here in the city get their teeth into it! As the spudding of Bentley fast approaches the excitement here will correspondingly rise, hopefully pulling the sp way, way up.

Daniel.

To watch a series of short videos explaining the basics of technical analysis, click on this link: http://link.brightcove.com/services/player/bcpid442837340 underneath the Bentley graphic.

Thanks so much for this Dan.

Nice work, a really good read.

THE MANNER IN WHICH YOU HAVE REPORTED IS VERY VERY GOOD AND I WOULD BE THANKFUL IF YOU WOULD PLACE MY EMAIL ADDRESS IN YOUR MAILING LIST ABOUT THIS SHARE AND ANY OTHER MINING SHARES PARTICULARLY IN THE OILIES.

Please insert my email address in your mailing list as I appreciated your article as a very good read and extremely good.

Yep good work dan

I think the shares have moved up, might get too £1.20 but post spud drop a bit before the BIG push

note 60 days i believe 45 days

regards

Item from Guardian today pertaining to crude oil demand which says cost of crude ‘predicted to’ top $100 per barrel!

No wonder heavy oil is becoming more popular. Any oil is better than none in supply and demand terms.

That’s a very good point and it got me thinking about gold.

Lets assume that there are hypothetical mining assets currently producing 4/5 grams of gold per ton of ore.

Then a company finds a play that can produce 4/5 grams per 1.10 tons.

Company A gets 40/50 grams of gold per 10 ton of ore

Company B gets 40/50 grams of gold per 11 ton of ore or you could reverse it

Company A gets 4/5 grams per ton of ore

Company B gets 3.6/4.5 grams of gold per ton of ore. The fact is it’s still gold!

Daniel