Today I expose the truly dreadful deceits perpetrated by the well known Aussie’ Shysters Controlling Andalas Energy & Power (LON: ADL). I urge every ADL Muppet, Poltroon and ‘Melt’ as well as Genuine Investors/Traders to read this and take a look at the RUPTL Indonesian National Electricity Plan at the end of this article.

Today I expose the truly dreadful deceits perpetrated by the well known Aussie’ Shysters Controlling Andalas Energy & Power (LON: ADL). I urge every ADL Muppet, Poltroon and ‘Melt’ as well as Genuine Investors/Traders to read this and take a look at the RUPTL Indonesian National Electricity Plan at the end of this article.

The sooner you all come to terms with the Truth the Better. You have been sold a ‘pup’.

At 8am today a full complaint was lodged with ALL the relevant authorities. The Nomad Cantor Fitzgerald, they of African Potash infamy, have failed once again to pick up on the true situation within ADL. The company are bust and attempting to artificially inflate their SP prior to placing.

Dan

ADVFN International Financial Blogger 2017

Mr. Daniel Levi

** ******* Road

******** Manchester

*** ***

EMAIL administrator@brokermandaniel.com

Telephone: 07703 ******

F.A.O.

Aim Regulation

The Financial Conduct Authority

- August. 2017

Open Letter to Aim Regulation and The Financial Conduct Authority

The Andalas Energy & Power Fraud.

Dear Sir/Madam

I wish to bring to your attention what I believe and documentary evidence as well as Indonesian sources supports, a deception/fraud that is being perpetrated by Andalas Energy & Power (LON: ADL) a London listed Alternative Investment Company. This is very serious.

On the 8th August 2017 Andalas released an RNS to the market and investors that contained material inaccuracies regarding a Jambi 1 Independent Power Plant (IPP) to be constructed in the Indonesian province of Jambi, termed ‘Jambi 1 IPP’.

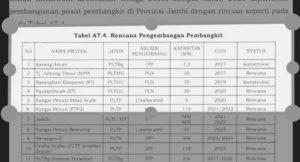

On investigation by myself and others it is apparent that no ‘Jambi 1 IPP’ exists in Indonesia at any government, national or regional level or within any state-owned company in any way shape or form. In order for one to exist it has to be registered on the RUPTL which is the Indonesian Government National Electricity Plan. A copy of the National Electricity Plan is attached, you’ll note that there is no ‘Jambi 1 IPP’ listed. Indeed, there is no entry on the Regional (Jambi) Electricity Plan which must follow the National Electricity Plan.

There is only one 30 MW IPP listed and that is PAYOSELINCAH which is owned by the state run Electricity company PLN. The date of construction is 2020.

The agreement trumpeted out on 8th August was, like other RNS’s released by Andalas, an attempt to artificially inflate their share price so that they could raise cash. The number of shares traded on 8th August was circa 1,000,000,000, the share price rose some 65%. This also needs to be investigated.

Investors daft enough to have bought stock have been misled in many respects insofar as how an IPP is progressed to its ultimate conclusion. The deliberate omissions of the structure, regulatory and funding requirements of progressing an IPP in Indonesia as well as the inferences of how this agreement would bring value to shareholders and the company is wholesale market abuse. The CEO of Andalas, Whitby, has stated that the construction of ‘Jambi 1 IPP’ can bring in revenues of $10,000,000 per annum for the next 20yrs. This is yet another desperate attempt by Andalas to mislead investors so that they can get away a placing.

I repeat no ‘Jambi 1 IPP’ exists in any way shape or form on official government registers, national plans or state-owned companies, other than the newly formed small subsidiary PPE which has just started into Upstream Investments. The agreement isn’t with the State-Owned Construction Company, PT PP (Persero) Tbk, it’s with a very and I mean a very small newly formed subsidiary. It has been confirmed to me that Indonesian Due Diligence performed by the ‘Sub’ has only considered that Andalas are a London listed company. That is, it. The subsidiary and the national state-owned construction company as well as Pertamina and PLN the state-owned electricity company, are not aware that Andalas Energy do not have the funds to progress a sweetie shop, let alone 49% of a $25,000,000-$30,000,000 IPP funding requirement.

The progression of the non-existent ‘Jambi 1 IPP’ in Indonesia is wholly dependent on funding. No deal struck with PPE can advance because their partner Andalas Energy has no cash. Andalas must have known this.

At the time of writing ADL have less than £100,000. As well as an outstanding £600,000 loan note that keeps having to be extended at £50,000 per ‘pop’ to keep the holder of the Loan Note, Sandabel Capital, at bay, not to mention the usual costs incurred by an AIM listed company. For any company to enter into an agreement that they do not and never will have the finances to fund is fraud. Andalas are insolvent.

A 49% funding requirement for the ‘project that doesn’t exist’ is $12,500,000- $15,000,000. Money that ADL simply do not have and never will have. Ergo it is a bogus RNS specifically designed, like many other ADL RNS’s, to artificially inflate their share price adding momentum to the SP so that they can raise cash. It is disingenuous and highly misleading for the company to suggest that this is a ‘Value trigger’. Andalas know full well that this is not the case.

The regulatory hoops in Indonesia require a KSO contract with Pertamina as well as a bank guarantee and a down payment to Pertamina. In-order to get the KSO Andalas have to prove that they have their 49% of funds in place. If ADL can’t get a KSO agreement with Pertamina then they have to obtain a Gas Trading Licence from SKKMIGAS to buy gas from Pertamina. Again, proof of funds is needed, as is a gas storage facility costing $2M-$3M. With no funds, they can’t approach Pertamina to buy gas, which again is dependent on proof of their funding as well as a fully funded completed feasibility study. No funding means, no KSO, no deal with Pertamina, no deal with PPE, no deal with PTPP, no gas sales licence and certainly no deal with PLN. That is the stark reality of the situation as of today. Andalas deliberately misled by omission on the above.

Furthermore, if Andalas won the euro millions and were awash with cash and could progress the fantasy that is ‘Jambi 1 IPP’ on passing and jumping through all the hoops the project would then, under Indonesian National laws go out to public tender. That is to say that ADL would then have to openly bid against any and all other companies to secure the rights to the ‘Non-existent Jambi 1 IPP’.

Whitby has stated that ‘The project is expected to qualify for direct appointment (i.e. without public tender) under Regulation No. 11/2017’ this is sheer fantasy and highly misleading as regulation No 11/2017 has four prior conditions which must be met in-order to avoid Public Tender which are thus;

1/ The natural gas price shall not exceed 8% ICP/MMBTU;

2/ The period of the guarantee of availability of natural gas should be equal to the period included in the SPA’s sale and purchase provision;

3/ Power plant investment cost calculation shall be depreciated with a minimum period of 20 years;

4/ Efficiency of the electric power and the specific fuel consumption (SFC) shall be equivalent to a high-speed diesel (HSD) of 0,25 liter/kWh.

None of those four conditions can be extrapolated several years ahead. Especially the natural gas price NOT exceeding 8% ICP/MMBTU. If you could extrapolate this one condition alone with any degree of certainty several years prior you’d be a multi billionaire! The ‘project’ cannot be “expected to qualify”, that is subjective supposition and yet again highly misleading, based on a crystal ball mentality. Andalas must know this and have not declared it.

As for the timeline of 2019, it’s my understanding from very well placed Indonesian sources, that this could not happen in 2019. It would be after 2020 at the very earliest. The reason for this is that it doesn’t exist on the RUPTL and could never get on the RUPTL until at least 2020. Andalas must have known this.

I now turn to the role of the Nominated Advisor (Nomad) Cantor Fitzgerald. Firstly, I must make it clear that I do not seek to apportion blame, merely to assist Cantor in understanding why they failed to pick up on all the above. I believe that just like the shareholders, the Broker and the Loan Note Holder Sandabel Capital, Cantors have been spoon fed misleading information that could only have been discovered by a ‘physical presence’ in Indonesia, Jakarta and Sumatra as well as the correct contacts within the Indonesian oil & gas community. Cantor Fitzgerald are on the whole victims of a complex series of deliberate manipulations.

Nevertheless, you as the regulators need to compel Cantors to explain why their safeguards and due diligence failed to pick up that ‘Jambi 1 IPP’ does not exist and has never existed as well as the deliberate misleading claims by Andalas. The questions are myriad and I do not propose to go through them, suffice it to say that a full in-depth investigation by the Nomad with the appropriate action taken to safeguard not only shareholders but the integrity of the AIM is now warranted.

At the very least Cantor Fitzgerald should make direct contact with the State owned Indonesian companies; Pertamina, PLN, PT PP (Persero) Tbk and their subsidiary PPE to seek clarification. Not least informing each party that Andalas Energy & Power does not have the funds and will never have the funds to build an IPP.

They should also clarify exactly what each company does or does not know about a ‘Jambi 1 IPP’ and what Indonesian regulatory National procedures with finances and timelines required to advance an IPP.

At the same time action needs to be taken to protect stakeholders and shareholders against further “Neville Chamberlain” pieces of paper of which there have been many, promising the earth and delivering nothing, as well as a thorough re-visitation and examination of all past agreements that have never amounted to anything other than failure to deliver, not so much as a ‘Hill of Beans’ but have facilitated highly dilutive capital raisings which have allowed the corporate shysters controlling Andalas to fill their pockets with UK share-holder cash.

My conclusion and opinions on Andalas Energy are well known. What we have here is a bunch of Aussie’ corporate shysters who think they are smart enough to manipulate and fool the Indonesian Authorities as well as the UK London Stock Market using deceptions and highly misleading claims.

Daniel Levi